The how to get car insurance blog 2255

The Facts About Faqs About Auto Insurance - Nc Doi Uncovered

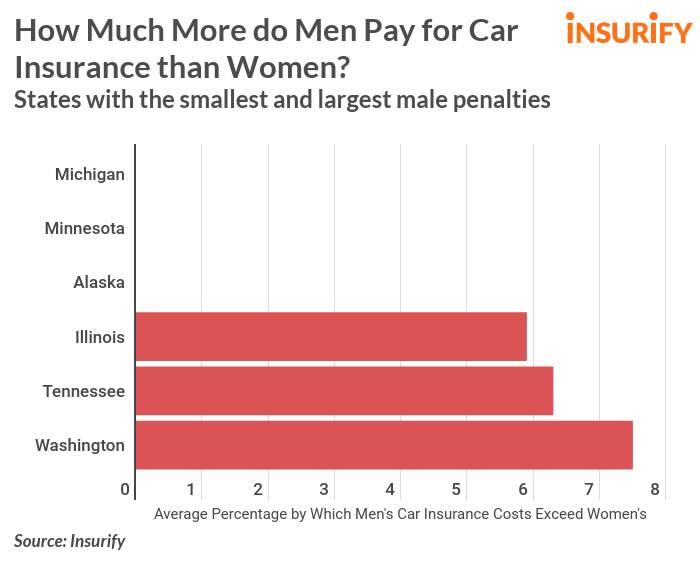

Keep in mind that your age will not impact your premium if you live in Hawaii or Massachusetts, as state regulations restrict automobile insurers from using age as a score aspect (vehicle). Furthermore, gender impacts your premium in most states.

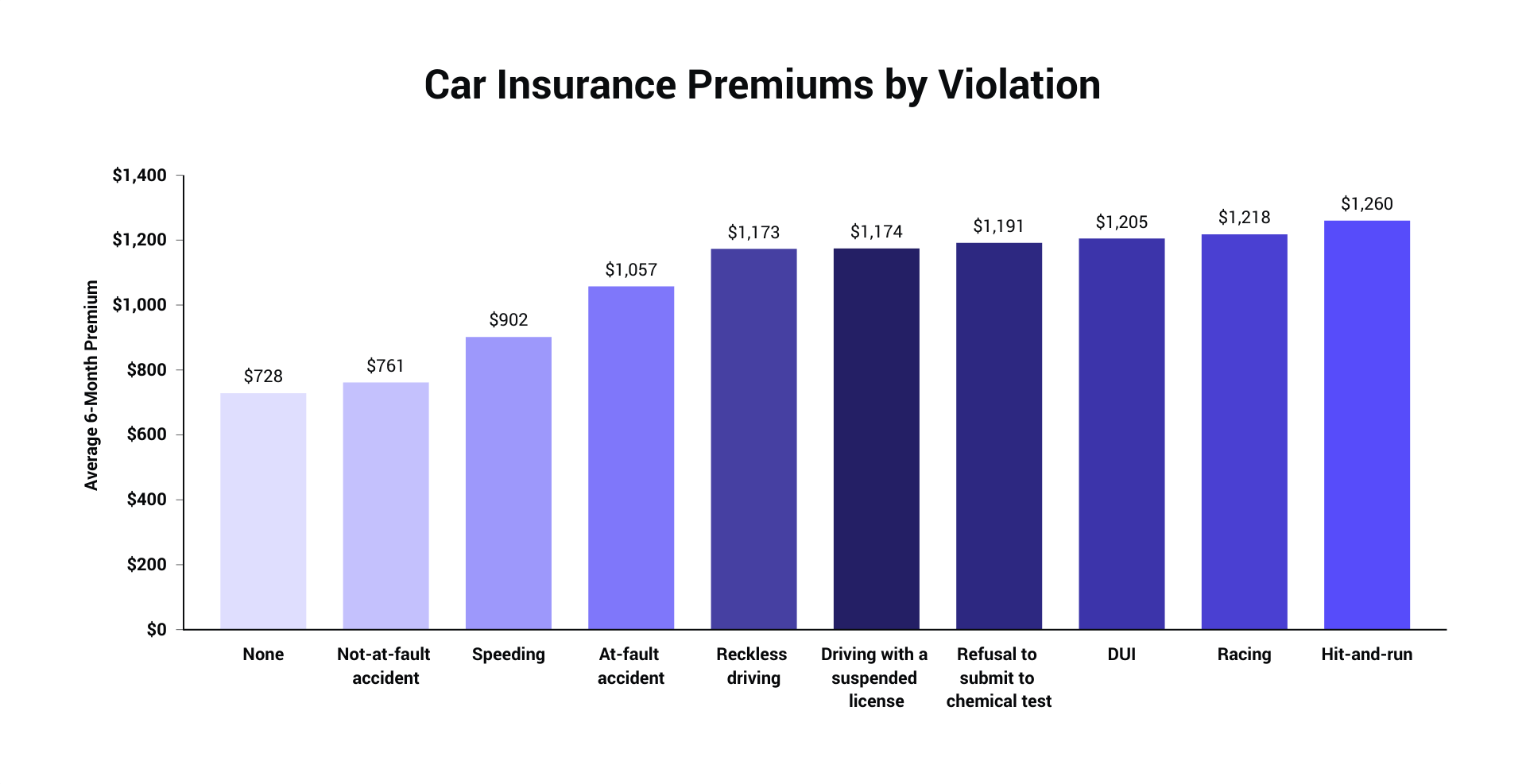

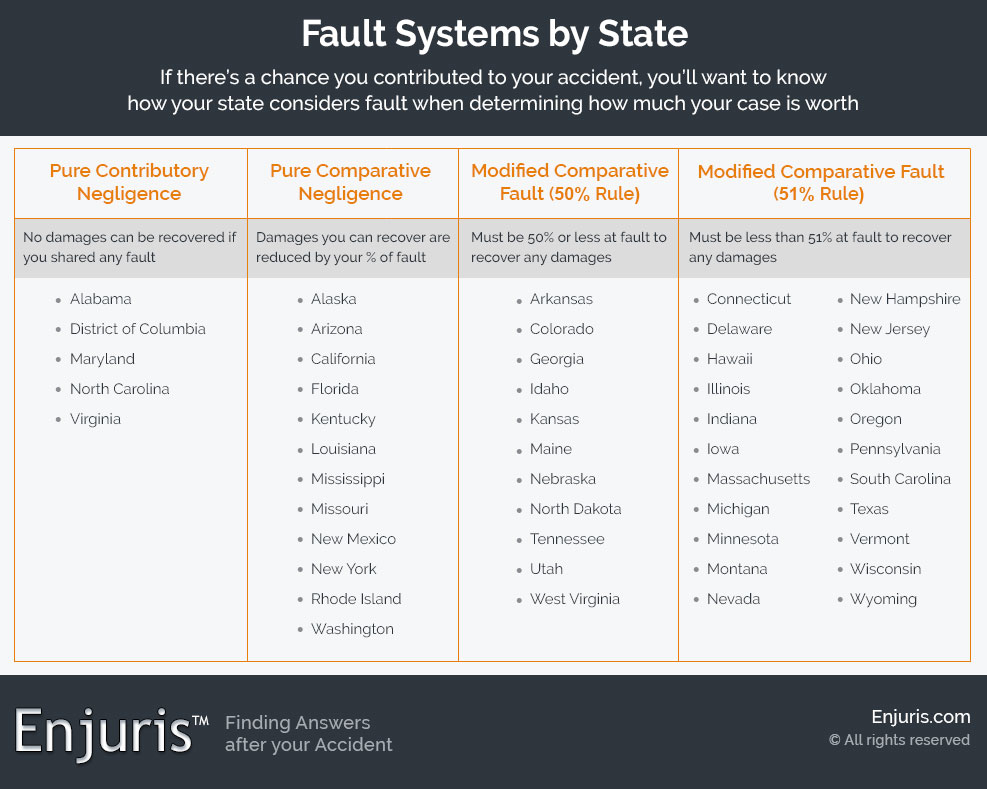

Being included in an at-fault accident will have an effect on your car insurance coverage. The amount of time it will remain on your driving record depends on the severity of the accident and state guidelines. As one of the most serious driving events, getting a DUI conviction usually increases your automobile insurance coverage premium more than an at-fault mishap or speeding ticket.

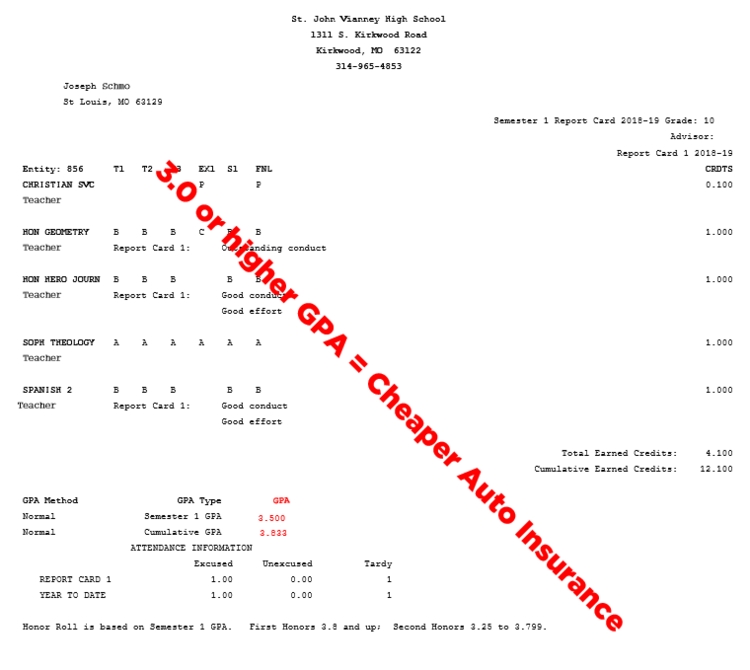

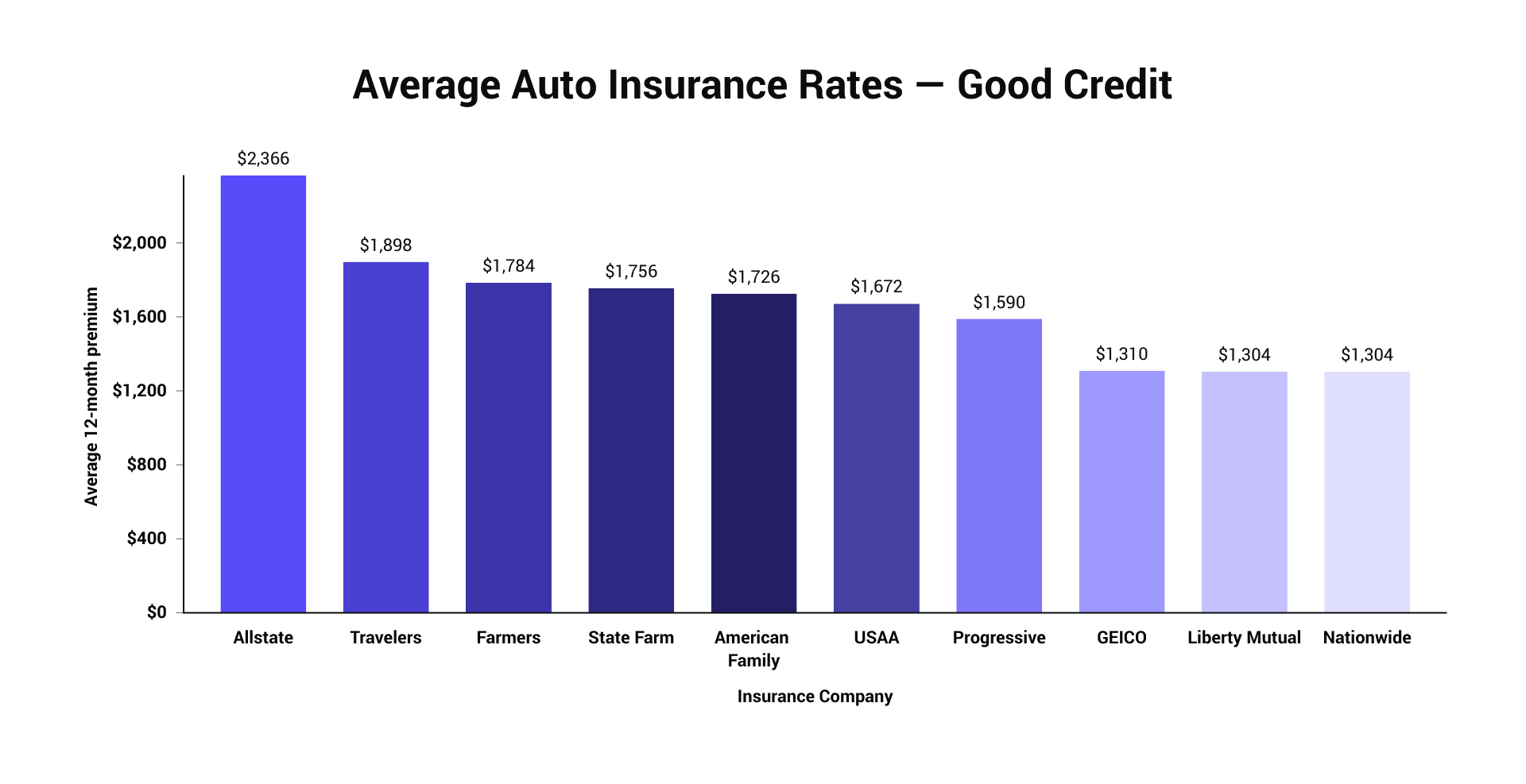

How much does car insurance expense by credit rating? This suggests that, in basic, the better your credit rating, the lower your premium., not a credit rating.

The automobile makes and models in the table listed below are the five most popular lorries in the U. low-cost auto insurance.S (affordable auto insurance).Some lorry makes and designs are considered more expensive to guarantee by insurance coverage business. These shared functions can include: The high price of these cars typically include costly parts and specialized understanding to repair in the occasion of a claim.

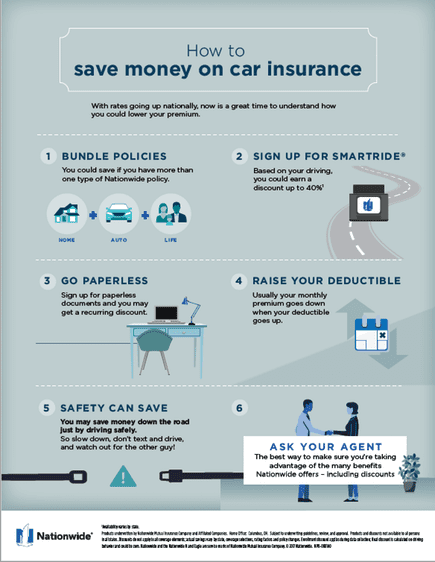

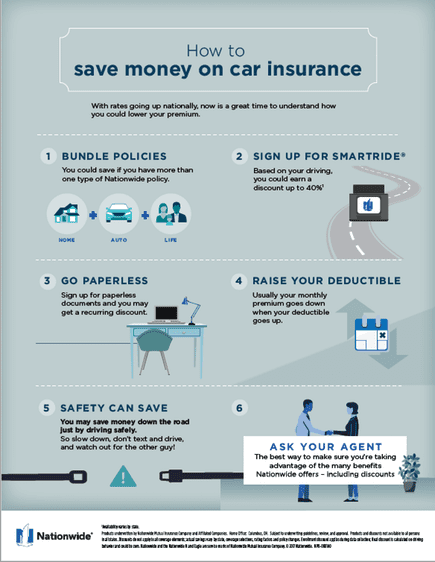

Insurance policy holders who drive less miles a year frequently receive lower rates (although this mileage designation varies by company). How to find the best automobile insurance rates, Purchasing automobile insurance coverage does not have to mean spending a lot; there are methods to save. cheapest car. Discounts are one of the very best methods to reduce your premium (credit score).

For this reason, insurance experts may recommend considering full protection car insurance coverage depending upon what vehicles you are guaranteeing and what properties you have in your name. If your car is financed or rented, it's most likely that you will have to bring complete coverage on your vehicle. Full protection frequently refers to higher liability limits and more coverage choices, like crash and thorough, to cover your lorry's damage.

The Ultimate Guide To Official Ncdmv: Vehicle Insurance Requirements - Nc ...

While full coverage car insurance coverage doesn't have a set meaning, it usually describes vehicle insurance coverage that has protection alternatives beyond the state minimum limits. Most full protection cars and truck insurance coverage will include medical payments protection, in addition to extensive coverage and crash protection to insure the vehicle. Having this extra coverage does suggest that your cars and truck insurance coverage may be more pricey than if you were only carrying the minimum liability limitations, but the advantage is that it might decrease your out-of-pocket expenses in the occasion of a mishap.

Insurance providers submit new rates with the departments of insurance in the states they serve every year, so your premium may undergo boosts or decreases that show these brand-new rates. Methodology, Bankrate uses Quadrant Info Solutions to examine 2022 rates for all postal code and carriers in all 50 states and Washington, D.C. trucks.

Our base profile chauffeurs own a 2020 Toyota Camry, commute five days a week and drive 12,000 miles every year. These are sample rates and must just be utilized for comparative purposes. Rates were computed by examining our base profile with the ages 18-60 (base: 40 years) applied. Depending on age, drivers might be a tenant or property owner - car insurance.

Bankrate ratings, Bankrate Scores primarily show a weighted rank of industry-standard ratings for financial strength and client experience in addition to analysis of priced quote yearly premiums from Quadrant Details Services, spanning all 50 states and Washington, D.C. We know it is essential for chauffeurs to be confident their financial defense covers the likeliest risks, is priced competitively and is provided by a financially-sound company with a history of positive consumer support. vehicle insurance.

When you've selected a policy, merely pick a payment option to finish the transaction (affordable car insurance). After that, you can download your evidence of insurance card and print it out.

More About Idoi: Auto Insurance - In.gov

While there are a few methods to get car insurance, the finest and most efficient way to get covered is by comparing quotes from numerous business online (perks). That method you can rapidly find the most affordable rates in your location for the protection you require. We do not sell your info to third parties (auto).

Then: How to purchase car insurance in 5 steps Figure out how much car protection you require, Fill out an application, Compare auto insurance coverage quotes, Pick a car insurer and get insured, Cancel your old automobile insurance plan 1 - cheap. Determine just how much automobile protection you require, Figuring out how much of each kind of automobile insurance protection you need is among the most fundamental parts of purchasing vehicle insurance. low cost auto.

2. Submit an application, Whether you're purchasing car insurance coverage for the very first or tenth time, you'll need the following information on hand: Names, birthdays and driver's license numbers for all chauffeurs in the family, Social Security numbers for all motorists in the home, VINs (Car Details Numbers) or make and design years for all vehicles, An address for the guaranteed (where you live and where the cars and truck is garaged, which is normally the same location)Your declarations page from your newest previous vehicle insurance coverage policy, if you have it, As you go through the process, you'll answer questions that can help make you discount rates on your coverage, like whether you have any mishaps or infractions on your record, whether you're a complete time student, and if your automobile is equipped with specific functions like an anti-theft gadget (affordable). It's normally a good concept to have higher coverage limits, even though including more coverage will affect how much you pay for vehicle insurance. You'll likewise need to choose deductible quantities for your detailed and crash protection. When you get a quote online or utilize a vehicle insurance coverage calculator, some optional types of coverage may immediately be included that you do not actually desire or require, so look thoroughly at whether there are any add-ons you can eliminate.

https://www.youtube.com/embed/5DE0AUfPpV8

We do not offer your info to 3rd parties. 3. Compare auto insurance coverage quotes, It's a good idea to get quotes from various business prior to you select a policy (suvs). You must likewise have an idea of just how much you can manage to spend for protection prior to you begin going shopping. Try to find the company that offers you the most defense at the most affordable rates (insurance affordable).

Not known Facts About Revealed – Which States Have The Most Expensive And ...

A business's monetary strength is a sign of its ability to pay you after a covered loss (cheaper auto insurance). Trying to find insurance provider with great monetary strength rankings from AM Best, S&P, and Moody's might help you feel more positive in a company's capability to pay claims. Get a sense of what clients think about the company.

If you are currently dissatisfied with your vehicle insurance coverage rate, consider searching by comparing your price to quotes from other companies. insure. You can also contact your existing business to see if there are any other discounts you are qualified for however are not presently receiving on your insurance coverage.

These are sample rates and should just be used for relative purposes - insure. About the Authors, Jessie has actually been writing professionally for over a decade with experience in a variety of different subjects and industries. She currently lives in the stunning Outer Banks where she works as a freelance author and marketing expert full-time.

Our list of the best low-cost vehicle insurer integrates trusted protection, financial strength, and first-rate customer service at an inexpensive cost for your family. affordable. How to Compare Cost Effective Car Insurance Coverage Companies There are a number of aspects to consider when comparing economical cars and truck insurance coverage companies. Insurance provider can differ in the coverage they offer.

If you get in an accident, how simple is it to submit a claim? Can you send it online, or do you require to call? Some companies have much better online interfaces than others, or permit you to talk to a local representative to discuss your policy and claims. Some even have mobile apps. cheaper car insurance.

Power for client service, industry rankings can assist you determine what to get out of an insurance business. Picking a Cheap Vehicle Insurer Prior to you choose any cars and truck insurance coverage business, we strongly advise putting in the time to shop your options. Collect and compare automobile insurance coverage prices quote from numerous companies to discover the best coverage for your needs at the finest price.

Not known Factual Statements About Travelers Insurance: Business And Personal Insurance ...

Base your decisions on which protections and deductibles you choose on the age and value of your automobile. While things like GAP coverage and collision/comprehensive make sense for more recent vehicles, they don't constantly provide any real advantages to drivers with older, high-mileage automobiles. How We Selected the Finest Inexpensive Vehicle Insurer Our team assessed 25 insurance coverage business and gathered thousands of data points before selecting our leading choices.

The money we make helps us give you access to complimentary credit rating and reports and helps us develop our other excellent tools and instructional materials. Compensation might factor into how and where products appear on our platform (and in what order). Since we typically make cash when you find an offer you like and get, we attempt to show you offers we believe are a good match for you.

One of the easiest ways to shop around for insurance protection is to compare automobile insurance companies online. If you prefer to evaluate insurance options with someone, working with a cars and truck insurance agent is another method to go. It's not simply your driving record that identifies the insurance estimates you get.

They utilize claims information and personal information, amongst other aspects, to evaluate this danger. In some states, your credit can have some influence on your premium (though California, Massachusetts and Hawaii have all banned the practice of utilizing credit-based insurance coverage scores to assist identify rates).

a 2015 Customer Reports study shows that single participants with simply "excellent" credit paid as much as a massive $526 more a year (depending on their state) than similar chauffeurs with the very best credit report. In addition to credit, your insurance rates might likewise be affected by the list below aspects: Specific areas have higher-than-normal rates of mishaps and lorry theft.

The more pricey your cars and truck is, the higher your insurance coverage rates might be. Insurance companies can likewise look at whether chauffeurs with the same make and model tend to file more claims or remain in more accidents, along with safety test results, cost of repairs and theft rate. Putting less miles on your vehicle every month can affect the rates you get.

What Does The Cheapest Car Insurance In The Us For Young Drivers Do?

They could all be at danger if you cause an accident that results in medical or home damage expenses that exceed your coverage limitation (laws). You might want to select coverage limitations that, at minimum, show the worth of your combined possessions.

He delights in offering readers with details that can make their lives happier and more extensive (cheapest car insurance). Warren holds a Bac Learn more. Find out more.

Do not focus on premiums alone when searching for low-cost insurance, Drivers looking for inexpensive insurance coverage should not jeopardize defense for price. While it's an excellent idea to search to discover a budget friendly automobile insurance coverage carrier, drivers need to watch out for dropping optional protection or maintaining only minimum protection in order to conserve on premiums.

Motorists might want to consider acquiring: Crash insurance to pay for damages to their own lorry if they trigger a crash. Uninsured/underinsured motorist coverage, which is needed in some states and which pays for the insurance policy holder's damages triggered by a driver who does not have any or enough insurance coverage.

Purchasing minimum necessary protection is unquestionably cheaper. The national average premiums for liability-only protection can be found in at simply $764. Nevertheless, without optional security, drivers could be forced to pay to repair or change their vehicle out of pocket if something fails. Their insurance would only cover losses they trigger to others.

Insurance companies take credit scores into account when setting premiums. That's why motorists will need to search more thoroughly to find the most cost effective providers when their credit rating isn't as high as they 'd choose. Based upon an evaluation of insurance data from numerous states, the most economical insurance companies for bad credit include: Geico: Geico offers economical alternatives for chauffeurs with low credit.

Some Known Facts About Farmers Insurance: Insurance Quotes For Home, Auto, & Life.

State Farm: State Farm likewise consistently offers more economical premiums for low-credit chauffeurs than competitors do - cheap car., a motorist will be more expensive to insure due to the fact that insurance coverage business fear another accident is likely in the future, suggesting the insurer may have to pay out another claim. Some insurance companies do not penalize motorists as much as others do, so vehicle drivers with an accident on their record should shop around carefully for coverage.

Insurance coverage can be frustrating, and we do not desire you to feel that way. low-cost auto insurance. We're here to assist you as you make the decisions for your distinct way of life and financial resources.

Get a car insurance coverage quote from The General by submitting your ZIP Code and some other information about any insurance coverage exclusions, credit history, and liability. Insurance provider check your ZIP Code for the number of mishaps in the location. If you live in a place with a high accident rate, usually metropolitan areas, expect to pay more for automobile insurance than someone living in a light traffic region.

Constantly inform the reality about any traffic offenses you've gotten, since the insurance coverage company will discover out, and it will impact your premiums. Some insurance provider will decline you if you did not have at least 6 months of prior vehicle insurance protection, but that's not the case with The General (automobile).

The 10-Second Trick For The Cheapest Car Insurance In The Us For Young Drivers

Insurer supplement that info by gathering large quantities of data from customer claims. cheapest car. More secure vehicles are frequently less costly to guarantee, and insurers often offer discount rates to consumers driving much safer cars. On the other hand, some insurance providers increase premiums for cars and trucks that have bad security records and are more vulnerable to damage or resident injury.

The longer an insurance provider guarantees a type or design of vehicle, the more data it needs to figure out reasonable prices - insurers. If the vehicle has constructed a solid track record over several years, odds are it will insure at a reasonable rate, and remain steady gradually. Alternatively, cars with bad security history or those that are a favorite target for thieves will be more expensive to guarantee.

Insurance coverage business have actually found that previous efficiency typically does foretell future outcomes. If you've had speeding tickets or mishaps, or other infractions within the last couple of years, your auto insurance rate might be greater than if you have a spotless driving record.

It simply makes sense, the more time on the roadway increases the possibilities of being associated with a crash or sustaining damage to your automobile (cheapest car). Size matters, You may think smaller automobile, smaller sized insurance premium. Not so quickly. In an accident, larger vehicles tend to fare better and keep residents much safer than smaller automobiles.

Anti-theft devices, If your cars and truck has an alarm, a tracking device to help police recuperate it, or another theft deterrent, it's less appealing to burglars, and less costly to guarantee, too. Your credit report, Research study has actually shown that excellent credit is connected to great driving and vice versa (insurance). Particular credit info can be predictive of future insurance claims.

The bottom line: Great credit can have a favorable impact on the expense of your cars and truck insurance coverage. Your age, sex, gender and marital status, Crash rates are higher for all motorists under age 25, specifically single males. Insurance costs in many states reflect these differences. If you're a trainee, you might likewise be in line for a discount.

The Greatest Guide To Top 11 What Is The Cheapest Insurance For Young Drivers ...

Where you live, Normally, due to greater rates of vandalism, theft, and crashes, city drivers pay more for automobile insurance than do those in towns or backwoods. You likely can't quickly alter where you live, but if you do reside in a high insurance location make sure to pay attention to the other elements that you can manage (cheap car insurance).

By doing some homework in advance about potential auto insurance rates, you can make a notified decision to ensure you have the right car at the best rate of owning it. See if ERIE can Deal a Cheaper Vehicle Insurance Rate, Ready to find out more about budget friendly vehicle insurance coverage from ERIE? Check out about our and begin an automobile insurance coverage quote today.

Great student discount rate Cheap vehicle insurance coverage for trainees is possible with Nationwide. Smart, Trip discount Smart, Ride is a tracking tool we use to reward safe driving. Here's where rubber genuinely satisfies the road plug the device into your automobile and it will track your driving practices, such as tough braking, speed and so forth.

https://www.youtube.com/embed/nRsmk-cFrb0

Where you keep your vehicle - Rates are identified to some degree by the area in which you live and park your cars and truck. The variety of chauffeurs on your policy If you include someone to your policy, your rate will increase, especially if that "somebody" is a new teenager driver.

The 9-Second Trick For Florida Full Coverage Auto Insurance

The average yearly cost of vehicle insurance coverage in Florida for a 40-year-old motorist with a tidy driving document purchasing a full insurance coverage plan is $2,208. insurance. The state minimal car insurance coverage for the same 40-year-old driver would just set you back approximately $1,123 per year. Prices varies dramatically with your driving account (perks).

Money, Geek looked into typical insurance policy prices in Florida based upon numerous elements to aid you recognize how these variables influence the prices. Ordinary Price of Cars And Truck Insurance Coverage in Florida: Summary, Cash, Nerd examined exactly how insurance rates in Florida adjustment with certain elements. The vehicle driver's age and credit report score most dramatically influence ordinary automobile insurance coverage rates in the state.Multiple aspects affect auto insurance policy costs. Florida is also understood for its vulnerability to all-natural catastrophes, which usually cause higher costs. Furthermore, Florida is a no-fault state. Insurance providers need to cover the insured despite that is at fault, causing high insurance coverage prices in the state. Average Price of Cars And Truck Insurance in Florida: Full Coverage vs. The typical cost of complete protection automobile insurance in Florida is $2,208 per year a substantial difference of $1,085. The quantity of protection you pick also influences the average expense of lorry insurance policy in Florida. Insurance companies offer several coverage options. Obligation protection is commonly the state minimum, with or without add-on coverages. The state rates 6th for its number of without insurance motorists, is vulnerable to natural catastrophes and also has a considerable price of lorry thefts. Its status as a no-fault state additionally adds to the state's costly automobile insurance coverage prices (trucks). Just how much should you spend for auto insurance policy in Florida? Estimate your standard insurance coverage premium in Florida by contrasting prices for chauffeurs who share your account and also attributes. Information on without insurance drivers was drawn from 2019 information from the Insurance Study Council. Urban share of populace was calculated utilizing the latest data from the united state Census Bureau. Information on automobile burglary rate was attracted from the FBI Criminal Offense in the United States Record for 2019 (cheap). Concerning the Author. When it concerns vehicle insurance coverage, Florida is one of the most pricey states in the country. Vehicle drivers in the Sunshine State pay approximately

$2,364 every year for full insurance coverage, according to Bankrate's 2021 research of typical yearly complete coverage vehicle insurance policy rates from Quadrant Information Solutions - cheap auto insurance. Just how much is car insurance in Florida per month? For full protection, chauffeurs pay concerning$197 each month, generally. The nationwide ordinary premium is $1,674 annually for full protection, which indicates that Florida vehicle drivers pay virtually$700 even more every year, on standard, than chauffeurs across the country.

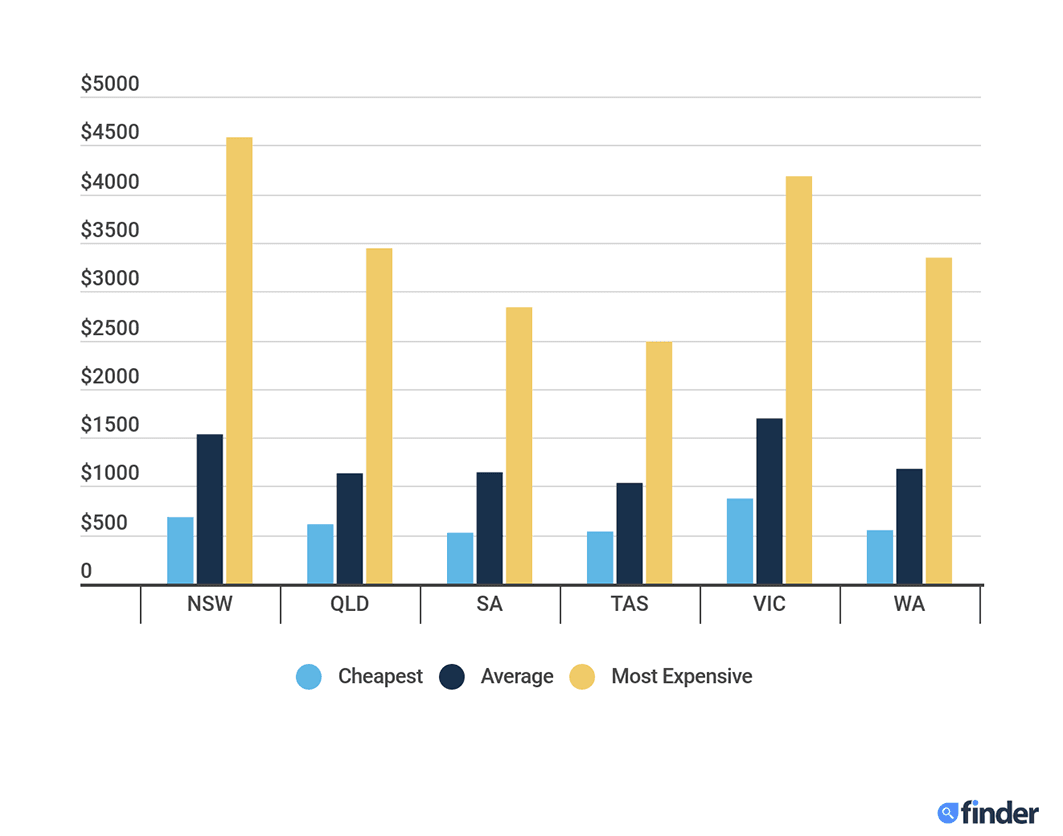

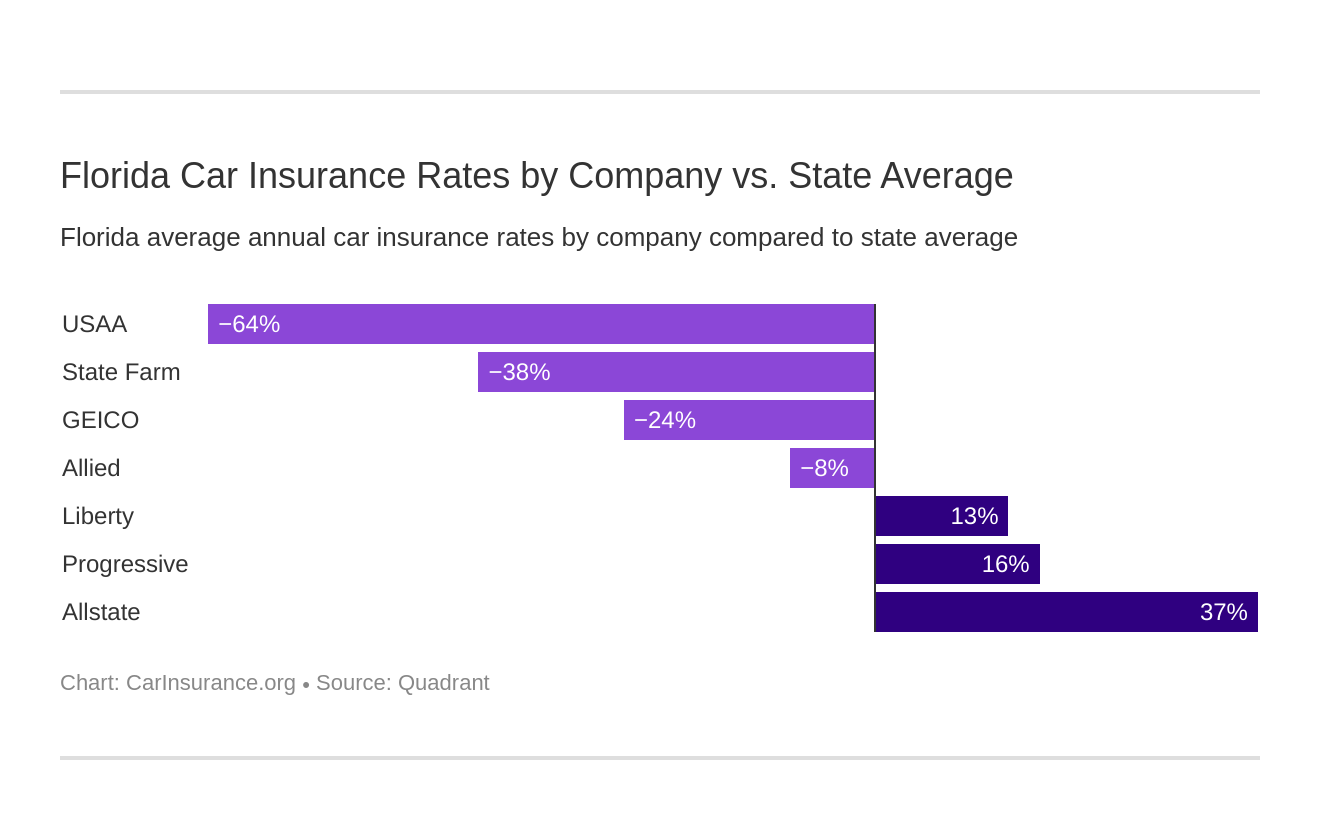

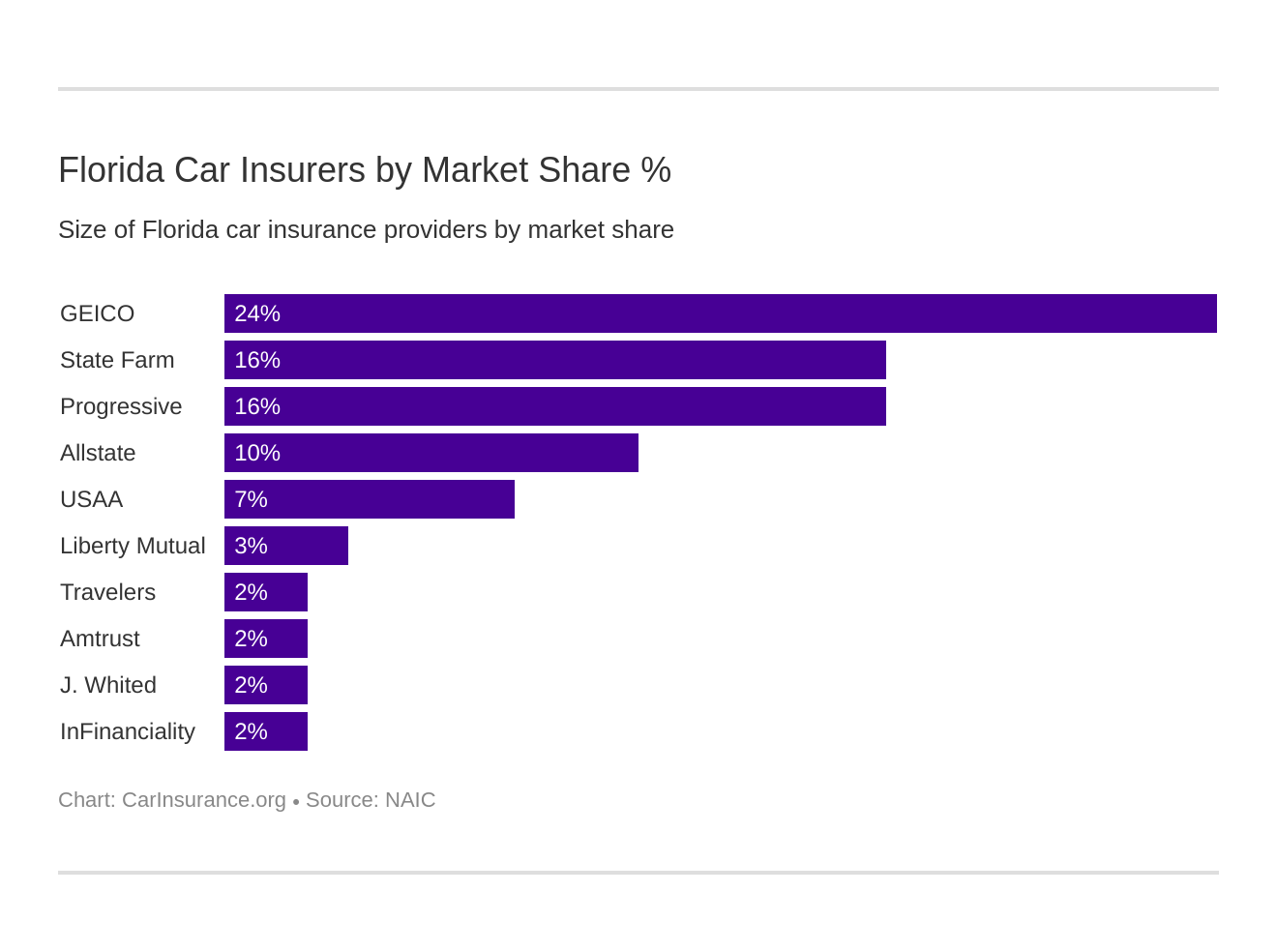

Bankrate's research study can assist you comprehend the typical cars and truck insurance coverage prices in Florida as well as the variables that affect your cars and truck insurance policy costs. Just how much is auto insurance in Florida? Florida drivers pay an average of$2,364 per year for full insurance coverage, which is 41 %greater than the nationwide yearly standard of$1,674. Nevertheless, your expense will depend upon a number of score elements, consisting of where you live within the state and also what insurance coverage kinds and also degrees you select. vehicle insurance. Florida car insurance coverage prices by company The most effective automobile insurance provider in Florida each have their own unique underwriting requirements, coverage offerings, discount rates and also policy functions. To provide you a concept of what you could anticipate to spend for vehicle insurance coverage in Florida, below are the average annual costs for complete protection for some of the biggest insurance provider by market share in the state. You might also desire to contrast coverage offerings, discounts, client solution scores and financial stamina ratings when picking an insurance provider. Price of living in Florida and cars and truck insurance coverage, When looking for the most effective cars and truck insurance coverage rates in Florida, it is essential to consider

your various other expenditures to ensure that you're looking at your overall living costs. If you are not sure how much time a surcharge might stay on your policy, you can call your insurance coverage representative or carrier to figure out. Florida vehicle insurance rates by car kind, Among the most significant elements in determining your automobile insurance coverage prices is the make and also design of automobile that you drive. The kind of lorry you drive can likewise affect just how much insurance coverage and what types of coverage you select. Frequently asked concerns, What is the most effective automobile insurer in Florida? Every driver brings a special collection of situations to their vehicle insurance coverage search, so the very best automobile insurance coverage business will certainly be various for everyone (business insurance).

When you understand what you desire from an insurer, you can acquire several quotes to assist you locate the insurance coverage you need at a competitive price. What is the typical cost of minimum insurance coverage in Florida? Having a vehicle policy with the state-required minimum coverage limitations in Florida sets you back a standard of$1,101 annually, virtually double the nationwide average of$565 annually. 4% uninsured vehicle driver price, one of the greatest in the U.S. according to the Triple-I, you may intend to consider including this insurance coverage on your plan. You might intend to think about higher responsibility restrictions or full coverage to better safeguard on your own in the event of a crash. Full insurance coverage, which includes crash coverage and detailed insurance coverage, is not called for by law yet will likely be needed if you have a funding or lease. These are sample rates and also need to just be utilized for relative purposes.: Prices were computed by examining our base profile with the ages 18-60 (base: 40 years)used. Depending upon age, chauffeurs might be a tenant or house owner. For teens, rates were identified by adding a 16 -or 17-year-old teen to a 40-year-old couple's policy. Prices were determined by evaluating our base account with the adhering to incidents applied: clean document( base ), at-fault accident, solitary speeding ticket, single DUI conviction and lapse in coverage. or Canada, PIP covers you as well as loved ones that stay in your house. In this instance, you should be driving your own vehicle. Individuals besides you or your relatives are not covered.(back to cover)Residential property damages obligation insurance policy pays for damages that you, or members of your family members, create to one more individual's residential property while driving. 1, 2007, you need to have$ 100,000 worth of protection each as well as$300,000 well worth of insurance coverage per accident. You also must have a minimum of $50,000 in residential property damage protection - automobile. BIL pays for severe as well as long-term injury or death to others when your automobile is associated with an accident and the motorist of your car is located to be to blame to some extent. It additionally covers individuals who drive your car with your authorization. With this kind of plan, the insurance provider likewise will certainly spend for your.

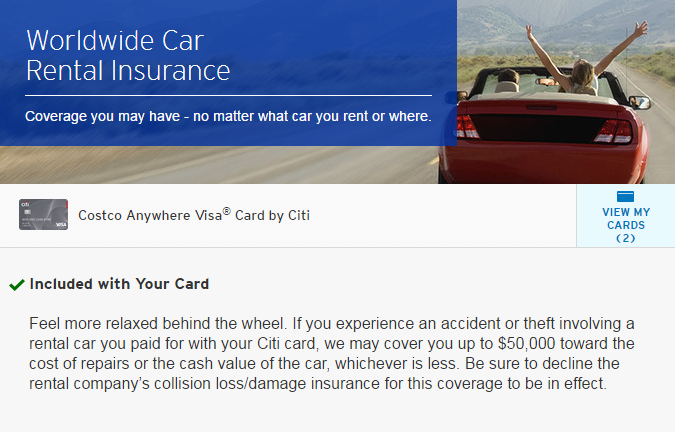

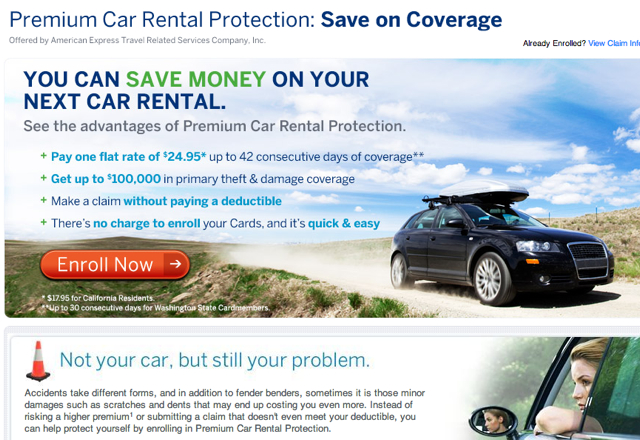

legal defense if you are sued.(back to cover )Although it is not required by legislation, several vehicle drivers buy other types of insurance policy coverage in addition to the required PIP as well as property damages responsibility insurance coverage. Accident insurance coverage spends for fixings to your auto if it hits another car, crashes right into an item or hands over. It pays no matter that creates the mishap. Crash insurance coverage does not cover injuries to people or damage to the home of others. Thorough insurance pays for losses from occurrences apart from a crash. Uninsured driver ( )insurance coverage pays if you, your passengers or relative are struck by someone that is "to blame"and also does not have insurance coverage, or has not enough responsibility insurance coverage to cover the overall damages endured by you. This applies whether you are riding in your automobile, riding in someone else's vehicle or are struck by a vehicle as a pedestrian. If you have crash protection or building damages responsibility, you might be covered for damages to rental vehicles driven by you, depending on the terms and problems of your plan. You also may be instantly covered by your charge card firm if you utilized the card to rent out the car.(back to top )Auto service warranties are great just for a specified length of time and also ensure just the fixing or substitute of items specified in the contract. Solution service warranties are agreements that are regulated by the Division of Financial Solutions. laws. Whether a service guarantee

is worth the money will certainly depend upon how the service warranty fits your requirements. Make certain to request the exact same insurance coverage from each so your contrasts will be exact. A quote is a quote of your costs it is not a firm rate or a contract. It is versus the legislation for a representative to deliberately quote you a low reduced costs to get your business - laws. False or inaccurate information could trigger the company to cancel your policy or refuse to pay a case. Constantly get a copy of the signed application kind. Make certain to obtain a binder from the agent when you authorize the application. A binder is your short-lived proof of insurance up until an official policy is released.

Make checks or money orders payable to the insurance provider never ever to the agent or the agency. You should get your plan no behind 60 days after the effective date. If you do not get your plan, contact your representative. Right away report any kind of changes impacting your plan to your representative. This needed coverage will not cover you if you are hurt in a motorcycle accident. Nonetheless, some insurance firms may supply PIP and clinical payment insurance for motorbikes as additional coverage that can be bought. In order to run or ride on a bike without headwear, you have to more than 21 years of age

All About Florida Car Insurance Guide (2021) - Carinsurance.org

and also have an insurance coverage providing at the very least$ 10,000 in clinical benefits for injuries suffered as an outcome of a crash. Finally, bear in mind these tips: Review your policy. cheaper auto insurance. Be certain you comprehend your plan. If you have any kind of concerns, call your representative or the Department of Financial Services toll-free at 800-342-2762. The selection of insurer and also agent is yours. You do not need to purchase auto insurance coverage from the dealer who sold you the cars and truck or the lending institution funding your vehicle. Insurance by State Florida Cars And Truck Insurance Coverage Florida is a no-fault state, suggesting that crash victims should look for recuperation for damages from their insurance providers, also if the various other motorist was accountable for the mishap. Bringing a lawsuit versus the at-fault vehicle driver is difficult, otherwise impossible under many circumstances - auto. Florida, like other no-fault states, has higher insurance policy costs than states without no-fault insurance coverage and is among the more pricey states in the country when it concerns vehicle insurance costs - cars. Florida Automobile Insurance policy Information No-fault insurance policy suggests all chauffeurs have to acquire minimum Personal Injury Defense(PIP)insurance policy and Home Damage Liability(PDL)insurance policy.

Icon-auto with a shield and also check mark- Accident Security insurance policy in Florida. The General Insurance automobile guard icon-Rapid, totally free quotes for fast protection Individual Injury Defense(PIP)Injury Protection Insurance policy covers the chauffeur as well as member of the family, in addition to anyone in the vehicle at the time of the mishap who does not have actually a signed up automobile and also PIP coverage. That exact same percentage likewise comprises the variety of foreign residents, among the largest in the country. Virtually 30 percent of youngsters talk a language aside from English in the residence. Florida Auto Insurance Policy & Accident Details Florida has the suspicious difference of the state with the largest variety of uninsured vehicle drivers. Area It prevails to pay more for business vehicle coverage in a larger city like Miami than a smaller city like Fort Meyers. Keep in mind, locations that experience even more claims are typically valued higher than various other locations. Locations at risk to weather-related occasions such as cyclones and also floodings are additionally variables. Understanding why the rates are so high in the initial place can help you lower your insurance coverage costs so you can delight in living in such an amazing state (credit). Why is Florida Vehicle Insurance Coverage

So Expensive? Due to the fact that Florida requires reasonably comprehensive cars and truck insurance, lots of people wonder concerning the cost of that kind of protection. Recognizing what these factors are can help you understand why insurance coverage is so costly there. Population, Florida has an unbelievably high population for its dimension, which makes it a really thick state.

https://www.youtube.com/embed/cC93FZEXYyc

Individual Injury Security Requirement, In the state of Florida, all chauffeurs are called for to have Individual Injury Protection insurance coverage. In Florida, there are a number of demographics that automobile insurance policy companies think about to be high risk. It needs to be kept in mind that demographics like this are starting to end up being less of a variable in automobile insurance policy costs as time goes on.

Facts About What Is The Process Of Switching Car Insurance In New Jersey? Revealed

Inspect on Needs for Automobile Insurance Coverage An individual need to cancel their existing vehicle insurance coverage policy by a business before purchasing the new insurance policy from another business to stay clear of void in insurance coverage. Not all insurance policy firms offer the same automobile insurance plans. A person that figures out.

auto insurance car credit cheaper car insurance

auto insurance car credit cheaper car insurance

his own requirements very own needs initially as well as ends study finishes from switching his car insuranceVehicle

There are a few suggestions a person can use to smartly switch their car insurance policy supplier. GST Update: GST of 18% is suitable on vehicle insurance coverage effective from the 1st of July, 2017. If you've been with the same auto insurance policy company for years, renewing your vehicle insurance coverage plan might seem like a piece of cake.

All states other than for New Mexico allow for electronic evidence of insurance. Speaking with your insurance agent and asking for a reduced costs can aid you locate below-average prices on your new cars and truck insurance coverage policy. Your insurance coverage affirmations page ought to reveal you what your present protection deals, yet here are various other variables to take into consideration when switching over insurance firms : If you want an exact replacement for your old insurance plan, examine whether you'll obtain a reduced price with a brand-new supplier when you include on the same kinds of vehicle insurance.

Altering automobile insurance due to an adjustment in lorry or vehicle proprietor Whether it is a modification of proprietor or a modification of vehicle, you can alter insurance. If you buy a car, you can take over the existing car insurance coverage. As some of the factors that impact your auto insurance rate change over time such as where you live, how much you drive, as well as your driving document you Visit this website may be able to get a lower price by switching your automobile insurance coverage to a different carrier.

In this short article Decide whether it's a great time to change auto insurance It's constantly a good suggestion to look around when annually or 2 to see to it you're obtaining the finest rate readily available to you. Yet there are some life occasions that may make it worth your time to consider automobile insurance coverage quotes from new insurer: One of the aspects that goes right into determining cars and truck insurance coverage prices is where you live.

How To Switch Car Insurance In 5 Easy Steps - Money - Questions

If you've transferred to a different postal code, it can affect your rate with your present policy, and also it's feasible another insurance company carrier can offer you a much better rate for that area (vehicle insurance). Insurance prices can vary for single motorists versus wedded chauffeurs, and some insurers may consider that element in different ways than others, which can lead to reduced prices.

In comparison, if you have far way too much coverage, you might be paying for something you do not need - insured car. Relying on your solution to these inquiries, you can simply alter your protection with your present insurance company. As well as if you're pleased with the modification in your costs based on those updates, you may not need to go any type of additionally.

cheap car insurance vans cheap auto insurance cheap insurance

cheap car insurance vans cheap auto insurance cheap insurance

Inspect your present insurance for fines In many cases, vehicle insurer allow you to cancel your plan without incurring an early termination fine or termination fee. You'll likewise commonly get a refund of the unused portion of your insurance premium. Yet ensure to review the fine print of your policy before you proceed.

As you search and also compare prices from various other insurance companies, you can run the numbers and see if the savings surpass the price of switching plans. Changing to a new carrier may conserve you a lot that it offsets the penalty from your old insurance provider. If it doesn't, you may require to wait till your old policy is up for renewal to make the switch.

If that happens, you might have the ability to switch off your old policy without incurring a penalty. Comparison store Buying around is the very best method you can conserve cash on auto insurance coverage (insurance company). Not just does each insurance provider weight elements differently, yet each typically additionally provides numerous auto insurance price cuts that can help in reducing your premium.

What To Know About Switching Car Insurance After An Accident Can Be Fun For Anyone

During this component of the procedure, it is essential to contrast rates from a minimum of 3 or four cars and truck insurance companies to get a concept of what you can get approved for. Some insurance web sites supply a comparison device that will do a few of that benefit you. auto. You just have to enter all your info as soon as, and also you'll get quotes from multiple auto insurance companies in one location so you can consider them side-by-side.

To put it simply, you have to actually use with that carrier to obtain a final quote, which may or might not be the same as the initial one. Make certain the auto insurance policy estimates you get back from any type of company include all the discount rates you certify for. And if you do see a far better quote from a completing insurance firm, call your present insurance coverage supplier and also see whether they want to make an offer to keep your business.

Cancel your old insurance coverage After you're particular that your brand-new plan is in pressure, take actions to cancel your old one. Quiting your payments might not be enough, and it might trigger some problems with your debt if you're reported for non-payment - insured car. Begin by calling your old insurance company as well as allowing them know you intend to terminate your policy.

Transforming vehicle insurance policy because of an adjustment in automobile or lorry proprietor Whether it is an adjustment of owner or a modification of automobile, you can change insurance coverage. The complying with alternatives exist: Replacing the proprietor. If you purchase a vehicle, you can take control of the existing automobile insurance coverage. You can alter cars and truck insurance policy if you are likewise the insurance holder (business insurance).

Getting vehicle insurance policy is crucial for vehicle proprietors, as well as depending on where you live and whether you financed your car acquisition, it might be called for. Sticking with the very same vehicle insurance business for a very long time may not constantly be the most effective idea. As some of the variables that impact your vehicle insurance policy price adjustment with time such as where you live, just how much you drive, as well as your driving document you may have the ability to obtain a lower price by changing your car insurance policy to a different provider. credit score.

Not known Details About 6 Reasons To Shop Around For Car Insurance Every 6 Months

In this post Determine whether it's an excellent time to switch over auto insurance policy It's always a great suggestion to look around when annually or 2 to make certain you're getting the finest rate available to you - auto insurance. Yet there are some life events that may make it worth your time to consider auto insurance policy estimates from brand-new insurance companies: Among the elements that goes into establishing auto insurance coverage rates is where you live.

If you've relocated to a different postal code, it can impact your rate with your present policy, as well as it's feasible one more insurance provider service provider can provide you a much better price for that location. prices. Insurance rates can differ for single chauffeurs versus married vehicle drivers, and also some insurers might consider that element differently than others, which could result in lower rates.

On the other hand, if you have far excessive coverage, you can be paying for something you do not need. Relying on your solutions to these concerns, you can simply transform your protection with your current insurance firm - cheap auto insurance. And if you're pleased with the modification in your premium based on those updates, you may not need to go any type of better.

Check your present insurance policy for charges For the most part, car insurance policy firms permit you to cancel your plan without sustaining a very early discontinuation fine or cancellation fee. You'll additionally normally get a reimbursement of the unused section of your insurance policy premium. But ensure to check out the great print of your plan prior to you continue.

As you go shopping around and contrast rates from other insurance providers, you can run the numbers and see if the savings outweigh the expense of switching policies. Switching to a new carrier may save you so a lot that it offsets the charge from your old insurance firm. If it does not, you might require to wait till your old plan is up for revival to make the switch.

Things about How To Switch Car Insurance (4 Steps) – Forbes Advisor

If that takes place, you might be able to change off your old policy without sustaining a charge. Comparison shop Buying around is the best means you can save cash on cars and truck insurance (cars). Not just does each insurance provider weight factors differently, yet each commonly also provides numerous cars and truck insurance price cuts that can help in reducing your premium.

During this component of the process, it is necessary to contrast prices from at least three or four car insurance firms to obtain an idea of what you can get. Some insurance websites use a contrast device that will do a few of that benefit you. vans. You simply have to go into all your details once, and you'll get quotes from multiple auto insurance coverage suppliers in one area so you can consider them alongside.

To put it simply, you need to really apply with that provider to obtain a last quote, which might or may not be the exact same as the preliminary one. Also, make certain the car insurance quotes you come back from any kind of company include all the price cuts you receive. As well as if you do see a far better quote from a completing insurance company, call your present insurance coverage company and see whether they agree to make a deal to maintain your business (risks).

https://www.youtube.com/embed/CBmtFPMUcr0

Cancel your old insurance coverage After you're specific that your brand-new plan is in pressure, take actions to cancel your old one. Stopping your settlements may not suffice, and it might cause some problems with your credit scores if you're reported for non-payment. Begin by calling your old insurance company as well as allowing them recognize you wish to cancel your plan.

How How Do I Switch Insurance From One Car To Another Car? can Save You Time, Stress, and Money.

cheaper cars cheapest car low-cost auto insurance vehicle insurance

cheaper cars cheapest car low-cost auto insurance vehicle insurance

Below are a few of the usual concerns regarding switching cars and truck insurance coverage, in addition to the responses that can assist you make the best choice for you. Is it bad to switch over cars and truck insurance policy firms? As long as you're not paying much more with the new insurance provider, there's no unfavorable impact involved with switching auto insurance coverage (vehicle).

Can you change your auto insurance protection at any time? Yes, you do not have to wait until your plan is up for revival to be able to change your coverage to a brand-new insurance firm. That claimed, consult your current business to see whether there's a charge associated with canceling your plan prior to the present duration ends.

Bottom line Vehicle insurance coverage can cost you hundreds or even countless dollars annually, so it is necessary to not just understand exactly how car insurance policy functions, however to likewise ensure you're constantly getting the most effective price readily available to you. If you have not examined recently to see whether there is a lower price readily available for you, currently may be a great time to do it.

Why would certainly you transform insurance after a mishap? Or possibly you were believing of switching business and you're questioning if that's still a choice after a crash.

Below's why you'll need to deal with two business. You can not reduce ties with your old insurance company altogether if you switch auto insurance provider after the accident; you'll need to cooperate to obtain outstanding insurance claims resolved (cheapest car). Your previous insurer should function the case the very same whether you're still with the insurance firm or not and would still have to safeguard you in suits connected to the crash.

Attempting to make plan modifications and offering a later date or time for the accident is insurance coverage scams. insurance. While not always perfect, it is feasible to change car insurance firms following an accident. To change after an accident, all superior cases have actually to be settled with the insurance coverage firm you're leaving prior to totally cutting ties.

The smart Trick of How To Switch Car Insurance In 7 Simple Steps (2022) That Nobody is Talking About

Many people look around and also switch insurers at the end of their policy term, but you can do it at any moment. We would not advise making any modifications on the very same day as a mishap. That may seem suspect to a new business, however rather, wait till after cases procedure has begun.

When making an application for a new insurance plan, you'll be asked a collection of inquiries to identify your threat. Those inquiries include ones concerning your driving record, mishaps and claims. Most insurance coverage firms ask about the last three to five years of driving, including speeding or website traffic tickets, and crashes as well as claims.

That insurance claim may be denied if you have actually placed in an insurance claim with the new insurance provider prior to it discovered the fib - automobile. Your insurance provider may be the cheapestfor now You may be fretted about just how Click here for more info your prices will increase after the crash with your current insurer, however when looking around you might find it is in fact the most affordable firm.

It can be that an additional firm does not rate as harshly for crashes as your current one. information shows that typically prices increase 31% (around a $450 increase each year) for one at-fault crash with more than $2,000 in damages. If the damage is under $2,000, it's a bit much better at just 26% (about $366 even more every year) (cheaper).

Some insurers supply a commitment discount rate for restoring with them year after year (regular variety of 3% to 4%) or a price cut for the amount of years you've stuck with them (variety of 2% to 5%). If you have your home and car guaranteed with the exact same business and are breaking up this bundle, you might shed a price cut of around 11%.

Then, there are the benefits. Do you have crash mercy with your current carrier? If so, it may deserve taking advantage of that for this mishap rather of transforming insurance firms. What regarding a disappearing insurance deductible? It typically takes at the very least a couple of years to end up being qualified for that perk with a brand-new insurance carrier, so you might lose it if you change insurers Changing automobile insurance provider after a mishap might still deserve it, but take into consideration the pros and also disadvantages of altering before making the leap.

The Single Strategy To Use For Can I Switch Car Insurance Companies Mid-policy?

If you're looking for a method to save cash on your automobile insurance, switching carriers might be the response. If you're really feeling like your existing policy is costing way too much, consider changing business and see if there are more affordable alternatives available - trucks. Below's just how you can change cars and truck insurance: It can be tempting to choose the first insurer that uses a reduced rate, but before making this choice do some study on what kinds of insurance coverage they offer and just how much insurance coverage you need.

Discover if there are any kind of fees for terminating your insurance policy. Generally, you can terminate totally free at any moment, however some companies may bill a cost if you cancel your plan midterm. Changing your car insurance policy before your plan runs out can bring about a lapse in protection. This suggests you will certainly not have insurance policy for a specific amount of time.

Currently that you have your brand-new insurance coverage, it's time to cancel your old policy. If you paid in advancement for your insurance policy and also you're canceling it to move to a brand-new insurance firm, you should obtain a prorated refund.

Some insurance coverage business charge a fine for canceling your plan before completion of your term. Usually, the fine is around 10% of your continuing to be premium, though some cost a flat fee, such as $25 or $50. Hence, if you're transforming to conserve cash, ensure it's still worth it with the cancellation fee factored in (risks).

Do not switch till a new plan is in place Switching insurance firms can be a clever relocation and also also save you thousands of bucks, yet having a gap in insurance coverage is not sensible - auto. Even a one-day space in auto insurance policy can be seen by insurance policy business and also make you viewed as a higher danger, which causes higher rates.

Additionally, a gap in vehicle insurance coverage protests the legislation in the majority of all states. Some states start to distribute fines, such as penalties if you're without cars and truck insurance policy on a licensed car for just one day. The most effective means to make the switch is to established the brand-new plan and also then terminate your old policy.

More About Florida Insurance Requirements

Otherwise, there could be a lapse in your insurance policy protection. Even if you switch over insurance provider, your open insurance claim will certainly not move. suvs. You will have to call the old insurance provider until the case is paid. Associated Articles.

Peter Dazeley/ Getty Images If you are transferring to a strange state, you might not recognize where to begin seeking vehicle insurance. An excellent place to begin your search is with your present insurance coverage representative. Your present representative needs to have the ability to search for various other agents in your brand-new area who market insurance policy via the same insurance service provider.

auto insurance cheaper cars auto insurers

auto insurance cheaper cars auto insurers

If you are relocating to a location where you have family and friends, you ought to definitely request referrals from them. Lots of big work environments are additionally able to suggest auto insurance policy representatives, especially if a large percent of their workers drive to and from job. cheaper auto insurance. Moving out of state is additionally an excellent time to obtain numerous quotes from various insurance coverage carriers.

Examine online to see what is readily available in your immediate area. Examining the local phonebook, or chatting with your new next-door neighbors to obtain a reference are additionally great ways to find a brand-new agent. cheaper auto insurance. You'll likewise discover that some little insurance provider only run in certain states instead of nationwide, and also several of these companies offer affordable prices and also wonderful consumer solution.

Photo: So you made the leap and also got a various vehicle. Whether it's brand-new or simply new to you, among the very first things you need to do prior to you drive it way too much is to see to it it's properly insured. Visualize this: You intend to obtain your auto insurance coverage taken off your old vehicle and also relocated to your brand-new cars and truck, yet you obtain active and also fail to remember (insurers).

Since you only brought obligation on your old automobile, you may not be covered for the damages (accident). This is simply one reason transferring your plan to your brand-new car is very important. If you sell your car to another person as well as don't transfer your insurance coverage to your brand-new car, you run the risk of not having the suitable insurance coverage, whether it's for property damages or responsibility.

Insurance Compliance Faqs - Ct.gov Things To Know Before You Get This

insurance vehicle cheap car business insurance

insurance vehicle cheap car business insurance

Learn why. The majority of the time, whoever purchases your old car will certainly get their very own insurance protection. In this way, if they are liable for an accident soon after they get your old auto, their insurer will cover the damages. When you get a various automobile, you will certainly have a specific amount of time as a "poise duration" to transfer your insurance coverage to your new automobile, which exact amount of time can vary from one state to another.

You will certainly need to supply the agent with: The year, make and model of the cars and truck The odometer analysis The VIN number The registration or title Your agent will also compare your current insurance coverage with the protection you want on your brand-new vehicle. More recent vehicles will cost a little bit even more to guarantee than older ones.

This will certainly assist you be prepared so you're not stunned if your rates are a little higherand on a more recent version, they may be. If you aren't expecting higher rates, it can take some of the happiness out of having a brand-new or "brand-new to you" vehicle.

Action 1: Cancelling your existing policy, Okay, so you've determined to change plans. cars. If you select to cancel, it may be best to do so at the end of your revival duration or payment cycle, so you can tire your staying cover. In a best globe, you would change to your brand-new policy and also is terminated.

Examine if they have an interior process for doing this (e. g. some business might require written notification), but in many cases, you can terminate over the phone; andin which your plan is to come to be inactive. Select a day that comes with the end of your existing repayment cycle so your insurance firm does not need to reimburse you any money (which can take time).

Bear in mind, you can still cancel the policy inside the cooling-off duration, as well as you won't sustain any type of expenses or fees. Step 2: Discover and authorize up for a new plan, Cancelling can be a discomfort, yet subscribing is basic! Utilize our website to compare your alternatives, locate one you like and also go from there.

All About Can I Change My Auto Coverage Whenever I Want? - Farmers ...

Normally, you're needed to supply the sponsors (i. e. that you obtained the loan from) with a certificate of insurance coverage. Your lending terms as well as conditions may detail that you call for insurance policy while the automobile is under financing.

Right here are 4 key aspects that encourage Aussies to change: to conserve moneyto obtain more for your moneyyour circumstance has transformed (new automobile, you have actually relocated, etc)to obtain discount rates. When altering insurer, can I do it before the revival date? Yes, you can transform your insurance policy carrier prior to the revival day of your insurance coverage - money.

cheapest car insurance automobile laws car insurance

cheapest car insurance automobile laws car insurance

https://www.youtube.com/embed/qvu3Uxb2wpI

I pulled right into my driveway yesterday, but when I hit my garage door opener, absolutely nothing took place. I needed to leave my automobile and also put in the code to obtain it to open up, which was less than perfect because rainfall was boiling down in containers. Exactly how can I reset my garage door opener?.

Some Ideas on How Much Should I Be Paying For Car Insurance? You Should Know

Given that every automobile insurance policy company assesses danger in different ways, you might be able to save cash by switching to Allstate - credit. Obtain an auto insurance quote from Allstate today to discover if you could begin saving cash. isn't an insurance coverage company; they shop rates from a wide variety of insurance firms to aid you discover the ideal rate for car insurance coverage.

Added vehicle insurance coverage choices Still interested in added treatment insurance choices? Summary The average vehicle insurance coverage month-to-month price is concerning $125 per month.

If a person has an existing insurance plan with AAA (or any kind of various other insurance policy company), they have a 14-day to 30-day elegance duration to guarantee their new cars and truck, depending on the type of policy (vehicle insurance). If a private acquisitions a new cars and truck and has never ever had an insurance coverage plan in the past, they require to buy insurance coverage before they drive off the lot.

You can additionally use the AAA Mobile application to pay your expense. Just log in and also, on the residence web page, scroll down to Account Actions. Just beneath that, under Insurance policy, click "Pay Your Insurance.".

Yes, The General automobile insurance supplies full insurance coverage for vehicle drivers. Full insurance coverage includes not just extensive and crash insurance policy, yet uninsured or underinsured vehicle driver insurance coverage.

There are too numerous without insurance or underinsured drivers when driving, and getting involved in an accident with one can really hurt you monetarily without this kind of coverage. How much coverage you'll need depends on your personal situation. If you have properties, such as a residence or financial investments, you want to make certain you have sufficient insurance policy in situation of a serious accident.

The Ultimate Guide To The Cheapest Car Insurance For College Students

cheapest insured car low-cost auto insurance cheapest

cheapest insured car low-cost auto insurance cheapest

If you do not have much in the way of assets, you will not need as much insurance policy, but you have to bring the minimum quantity of insurance required to legitimately run a lorry in your state.

The average expense of auto insurance in the United States is $2,388 per year or $199 each month, according to data from virtually 100,000 insurance holders from Savvy. The state you reside in, the degree of insurance coverage you would certainly like to have, as well as your gender, age, Click here to find out more credit report, as well as driving history will all aspect into your premium - cheap auto insurance.

Automobile insurance coverage have great deals of relocating components, as well as your premium, or the price you'll pay for coverage, is simply one of them. Insurance policy is managed at the state level, as well as laws on required protection and also rates are various in every state - suvs. Insurance business take into consideration several variables, consisting of the state and also area where you live, as well as your gender, age, driving background, as well as the degree of coverage you would love to have.

Here are the greatest variables that will certainly influence the cost you'll spend for coverage, as well as what to take into consideration when considering your vehicle insurance policy choices. There have been some huge modifications to car insurance coverage expenses during the coronavirus pandemic. Some auto insurance providers are supplying discounts as Americans drive less, as well as are likewise assisting people impacted by the infection hold off settlements.

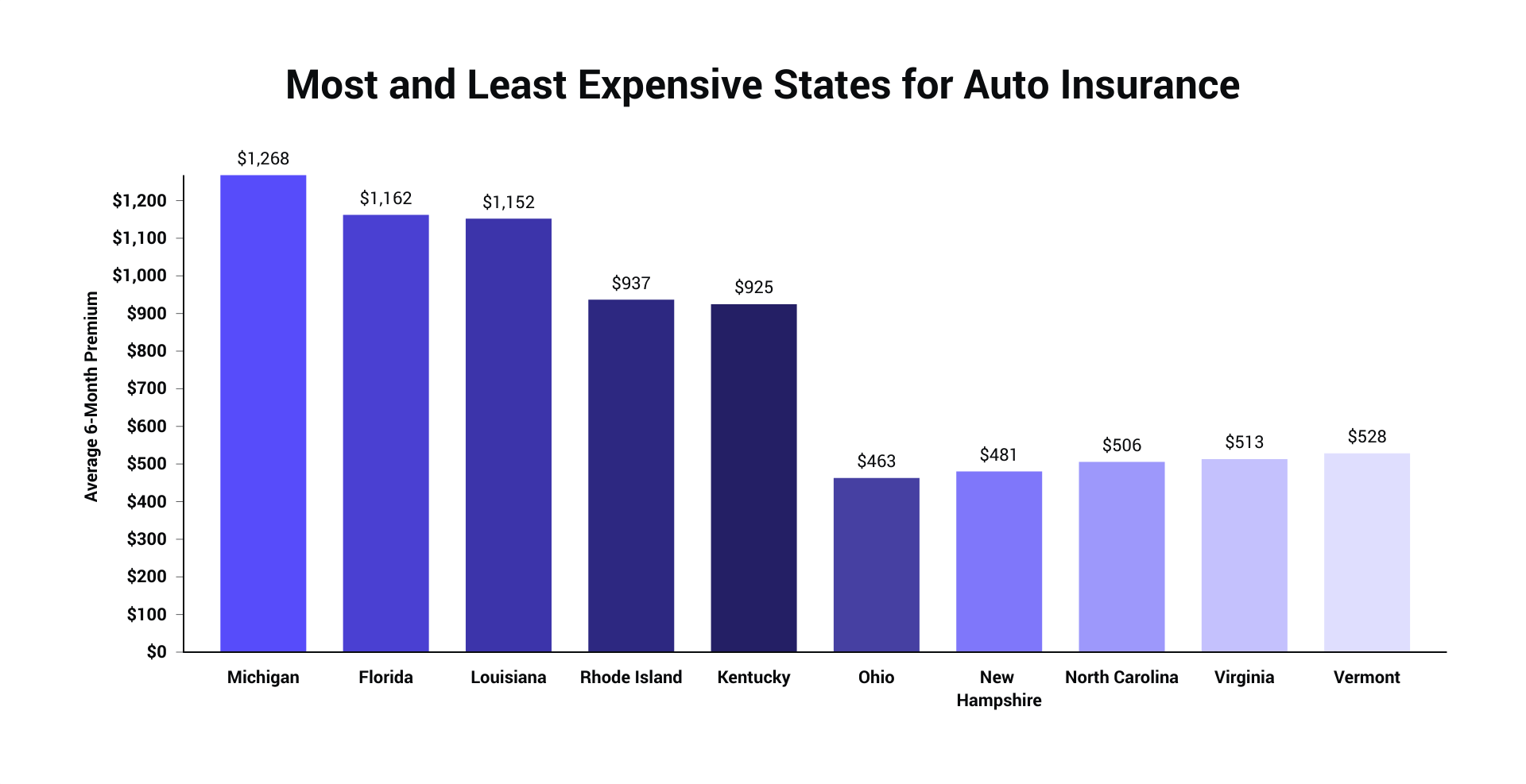

Business Expert assembled a listing of typical car insurance coverage costs for each state. These prices were figured out as a standard of rates reported by Nerdwallet, The Zebra, Value, Penguin, Bankrate, and the National Association of Insurance Coverage Commissioners. Here's a variety auto insurance expenses by state - cheap car insurance. Source: Data from Nerdwallet, Worth, Penguin, Bankrate, The Zebra, as well as the National Organization of Insurance Commissioners.

And from Business Insider's information, auto insurer have a tendency to charge females much more. Company Expert collected quotes from Allstate and State Ranch for standard insurance coverage for male as well as women drivers with a the same account in Austin, Texas. When exchanging out just the sex, the male account was estimated $1,069 for coverage annually, while the women profile was quoted $1,124 annually for insurance coverage, setting you back the lady driver 5% more.

The Facts About Average Cost Of Car Insurance (With Quotes, Updated April ... Revealed

In states where X is a gender option on driver's licenses including Oregon, California, Maine, and also quickly New York insurers are still figuring out exactly how to calculate expenses. Average auto insurance costs by age, The variety of years you've been driving will certainly impact the rate you'll pay for insurance coverage. While an 18-year-old's insurance averages $2,667 (credit).

vehicle cheap car insurance insured car affordable car insurance

vehicle cheap car insurance insured car affordable car insurance

This data was given to Organization Insider by Savvy. Exactly how cars and truck insurance prices alter with the number of cars and trucks you own, Somehow, it's rational: the much more autos you have on your policy, the greater your automobile insurance policy costs. Yet, there are likewise some savings when multiple cars and trucks are on one plan.

Auto insurance policy is less expensive in zip codes that are a lot more country, and also the same holds true at the state level. Insure. com information shows that Iowa, Idaho, Wisconsin, as well as Maine have the cheapest auto insurance coverage of all states, which's because they're extra rural states. Other aspects that can influence the price of automobile insurance policy There are a couple of other factors that will certainly contribute to your premium, consisting of: If you don't drive lots of miles per year, you're less most likely to be associated with an accident.

Each insurer checks out all of these factors and also rates your coverage in different ways therefore. It's crucial to contrast what you're provided. Get quotes from a number of various automobile insurance coverage business and contrast them to make sure you're getting the most effective deal for you. Personal Financing Press Reporter.

The ordinary yearly cost of car insurance in the U.S. was $1,057 in 2018, according to the most recent information available in a report from the National Association of Insurance Coverage Commissioners. Nonetheless, recognizing that fact will not always help you figure out just how much you will be spending for your own coverage.

To much better recognize what you need to be spending for automobile insurance policy, it's ideal to discover the means companies identify their prices. Keep reading for an overview of one of the most usual factors, as well as exactly how you can earn a few added cost savings. Computing Typical Annual Auto Insurance Cost There are a lot of aspects that enter into identifying your automobile insurance policy price (cheapest).

3 Simple Techniques For Most Expensive Cars To Insure - Benzinga

Below are some essential factors that affect the ordinary expense of cars and truck insurance coverage in America - perks.: Men are normally related to as riskier motorists than females. The data reveal that ladies have less DUI events than guys, as well as fewer crashes. When women do enter an accident, it's statistically less likely to be a serious accident.

cheap auto insurance prices affordable automobile

cheap auto insurance prices affordable automobile

The stats birth that out, with married individuals entering less accidents. As a result, wedded individuals minimize their rates. Something much less evident is at play below, also; if your state mandates specific requirements for car insurance coverage that are stricter than others, you're likely to pay even more money. Michigan, for instance, needs citizens to have limitless life time individual injury protection (PIP) for accident-related clinical expenditures as a component of their car insurance policy.

liability auto insurance car insurance low cost auto

liability auto insurance car insurance low cost auto

The second least expensive state was Maine, followed by Iowa, South Dakota, and Idaho - car.: If you are utilizing your automobile as an actual taxi or driving for a rideshare solution, you will have to pay even more for insurance coverage, and also you may require to spend for a various sort of insurance coverage altogether.

, just how frequently you use your auto, why you utilize your auto, and where you park all impact your premiums. If you drive a lot more commonly, you're exposed to the risks of the road a lot more frequently.

Installing tracking software program on your car could assist lower your premiums when you have a less-than-perfect history.: That very smooth sports vehicle you've always wanted? It's not just going to cost you the sticker cost: driving an important automobile makes you riskier to guarantee.

Insurance costs also account for the total security of a vehicle and the ordinary cost of fixings. If you're looking to save on insurance, buy a minivan, a practical car, or an SUV.

Not known Facts About New Drivers Face 80% Higher Car Insurance Cost Amid Price ...

You get what you pay forif you're in an accident, you'll possibly be grateful you really did not select this as a location to cut corners and also save on. On the various other hand, if you never need to make a case, you'll have pocketed the extra financial savings without effect.

: You might obtain a discount for getting different types of insurance coverage via your car insurance policy service provider, such as residence or rental insurance coverage (business insurance). Ask a representative what various other insurance coverage is readily available and also whether you would certainly obtain a discount rate for bundling the protection.

A vehicle insurance coverage can consist of numerous different sort of protection. Your independent insurance coverage representative will offer specialist recommendations on the type and also amount of car insurance protection you ought to have to satisfy your specific demands as well as comply with the regulations of your state. Here are the primary sort of protection that your policy might include: The minimum insurance coverage for physical injury differs by state as well as may be as reduced as $10,000 each or $20,000 per crash.

If you wound someone with your vehicle, you can be taken legal action against for a great deal of cash. The quantity of Obligation insurance coverage you carry ought to be high adequate to secure your possessions in the event of a mishap. car. Many specialists suggest a restriction of a minimum of $100,000/$300,000, however that may not be enough.

If you have a million-dollar residence, you could lose it in a claim if your insurance policy protection wants (cheap). You can get extra insurance coverage with an Individual Umbrella or Individual Excess Liability plan. The higher the worth of your properties, the extra you stand to shed, so you need to buy responsibility insurance coverage suitable to the worth of your assets.

You do not have to figure out just how much to buy that depends on the automobile(s) you guarantee. The higher the deductible, the lower your premium will certainly be.

The 10-Minute Rule for How Much Is Car Insurance? [2022 Cost Guide] - Marketwatch

If the vehicle is just worth $1,000 and the deductible is $500, it might not make good sense to purchase collision protection. Crash insurance policy is not usually needed by state law. Covers the cost of various damages to your automobile not triggered by an accident, such as fire and also burglary. Just like Crash coverage, you require to pick a deductible (car).

https://www.youtube.com/embed/UFEsQ9WTdRE

Comprehensive protection is generally marketed along with Collision, as well as the 2 are usually referred to with each other as Physical Damage protection. If the car is rented or funded, the renting company or lender may require you to have Physical Damages insurance coverage, also though the state law might not require it. Covers the price of clinical care for you and also your travelers in the occasion of a crash - trucks.

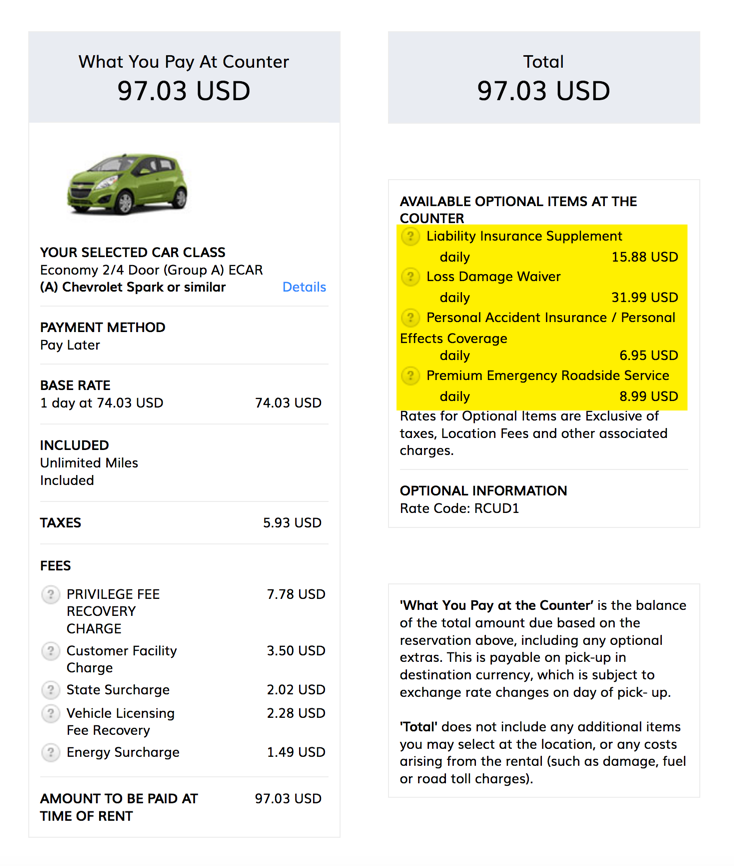

The Ultimate Guide To How Do I Get A Rental Car After My Car Accident In Georgia?

Edit your About page from the Pages tab by clicking the edit button.

The Main Principles Of What To Do If You Have An Accident In A Rental Car - Autoslash

Edit your About page from the Pages tab by clicking the edit button.

Car Rental Damage: What To Do If You Get Into An Accident? for Beginners

Edit your About page from the Pages tab by clicking the edit button.

Our The Four Types Of Rental Car Insurance, Explained Diaries

Edit your About page from the Pages tab by clicking the edit button.

Facts About Costa Rican Rental Car Insurance Explained (Sort Of) Revealed

Edit your About page from the Pages tab by clicking the edit button.

What Happens If I Get Into A Car Accident In My Rental Car? Fundamentals Explained

Edit your About page from the Pages tab by clicking the edit button.

The Basic Principles Of What Is A Car Insurance Deductible? - Credit Karma

Edit your About page from the Pages tab by clicking the edit button.

How Other Types Of Automobile Insurance can Save You Time, Stress, and Money.

Edit your About page from the Pages tab by clicking the edit button.

Not known Factual Statements About Automobile Insurance - Nc.gov

Edit your About page from the Pages tab by clicking the edit button.

Excitement About Single Deductible Endorsement - Progressive Commercial

Edit your About page from the Pages tab by clicking the edit button.

Fascination About How Car Insurance Works - Usnews.com

Edit your About page from the Pages tab by clicking the edit button.

The How To Choose The Right Car Insurance Deductible - Metromile Diaries

Edit your About page from the Pages tab by clicking the edit button.

All About Starter Replacement Cost: What You Need To Know About - Way

Edit your About page from the Pages tab by clicking the edit button.

All about Auto Insurance Revealed - How Many Us Drivers Don't ...

Edit your About page from the Pages tab by clicking the edit button.

Some Ideas on How Much Is Car Insurance In 2022? - Consumeraffairs You Need To Know

Edit your About page from the Pages tab by clicking the edit button.

The Greatest Guide To Car Insurance Prices - State Farm®

Edit your About page from the Pages tab by clicking the edit button.

Facts About The Best And Worst States For Auto Insurance Premiums - Money Revealed

Edit your About page from the Pages tab by clicking the edit button.

The Definitive Guide for Average Car Insurance Costs In Texas - Smartfinancial

Edit your About page from the Pages tab by clicking the edit button.

The Ultimate Guide To What Happens When Your Car Is Totaled - Mcintyre Law P.c.

, so do not be shocked - prices. Equally as you wish to be sure your cars and truck is properly repaired, they want to see to it they don't pay a grossly inflated repair service expense. Keep in mind that one factor that could minimize the amount of your insurance claim for a fixing job is what insurance provider call improvement.

They can firmly insist that you obtain even more than one quote for the work to be done on your cars and truck if they really feel the quote you received is as well high. You don't have to accept it if you think the amount won't sufficiently repair your auto. Don't wait to make your factors with with the adjuster if the fixing quote is as well reduced based upon what your technician has actually informed you.

trucks cheap business insurance cheaper

trucks cheap business insurance cheaper

Totaling a vehicle is a demanding situation considering that you have no method of navigating. When a car is totaled, it is taken into consideration a "failure" by the insurance business. Totaled vehicles usually have actually endured major damages, so they are commonly unusable. At Ladah Law Practice, our group frequently fields calls concerning completed lorries. low cost.

790. Essentially, this legislation specifies that your vehicle is considered amounted to when the approximated price of repairs exceeds 65% of the automobile's value (car). As an example, your cars and truck could have deserved $10,000 prior to the accident. If the price of repair services goes beyond $6,500, after that the car is totaled. Other states might use various computations, but this is the one taken on by Nevada's legislature.

The Buzz on Total Loss In Louisiana: Explained - Covington La Personal ...

In other words, it is the value of your vehicle quickly prior to it was entailed in a crash. Right here's what it's not: It's not what you spent for the cars and truck, or just how much you owe on the funding. It likewise isn't the cost of a substitute vehicle or what the auto deserved a year earlier.

There are some means to get to this number. An insurance policy insurer will certainly desire details concerning the repair history and any type of previous accidents you were in. They likewise will desire to consider the cars and truck to see what type of rust or damage existed independent of the damages brought on by the accident.

Share the name of the motorist who hit you as well as their insurance policy firm. The insurance firms will certainly get to an agreement in between themselves on responsibility for the collision, and also an insurance coverage adjuster will consider the vehicle to analyze the full level of damages. The adjuster will attempt to identify the lorry's condition immediately before the wreck and also just how much it was worth - auto.

We recommend making use of on the internet search tools, like Kelley Blue, Publication, which will certainly supply an evaluation based upon your subjective belief of the problem of your vehicle. Naturally, the number is just a starting point - cheap car insurance. You are not called for to approve the insurance company's deal, which indicates you have a possibility to work out.

The Definitive Guide for Attorneys For Leased Car Accidents - Bernstein & Maryanoff

Just saying you are dissatisfied possibly won't cut it. Am I Allowed to Keep the Auto? It's possible to discuss with the insurance provider to allow you maintain the car. Naturally, a completed vehicle does retain some value, and also your insurance company could have desired to offer it for scraps. low-cost auto insurance. So, you will receive less than you would certainly if you did not keep the vehicle.

Some people think twice to allow it go due to the fact that it has emotional value or since it was a hard-to-find antique. You likewise could have links with a body shop, which will repair your automobile at an extremely affordable (perks). To drive the vehicle, you'll need to apply for a salvage title.

A court or court needs skilled info to figure out the real value of your automobile. You can't simply present Blue, Book information as proof. If you win in court, you might receive more money for repair work. However, you should think carefully before taking this action. Frequently, you can bargain a more desirable settlement that does without the expenditure as well as headache of heading to court.

A day at Bridgestone's winter months driving institution shows why you ought to take into consideration transforming your treads symphonious with the periods. low cost.

The smart Trick of Is Your Car Totaled? How Much Will You Get From Insurance? That Nobody is Talking About

As many as 32% of vehicle drivers lease their automobiles (Automobiles, Straight). That suggests a huge portion of cars and truck accidents include leased lorries - credit score. When you're in a car accident with a leased automobile, it can be a little different than if you own the vehicle, and it's vital to take the appropriate steps to get the payment you are worthy of.

What Takes place If You Accident a Leased Car? If you're in a mishap with a leased cars and truck, insurance policy may cover fixings.