Fascination About 6 Reasons Why Auto Insurance Costs More For Young Drivers ...

, and also the kinds and also amounts of policy choices (such as accident) that are sensible for you to have all impact exactly how much you'll pay for coverage.

In the world of cars and truck insurance coverage, age is not just a number. It is a parameter utilized by vehicle insurance coverage companies to put a price on your car insurance policy premium.

Auto insurance coverage costs as per your age and also sex It shows up to be one of life's cosmic assurances that the younger you are, the greater your auto insurance coverage costs will be. cheapest car insurance. This isn't merely a perspective. Among the most crucial requirements in determining automobile insurance coverage costs is the age of the driver.

Let's look at these distinctive age as well as see just how high (or low) your prices are likely to be. The analysts at were able to create the ordinary cars and truck insurance coverage costs based on https://s3.us-west-1.wasabisys.com/florida-car-insurance-get-a-quote/index.html the motorist's age. The costs information is summed up in the graph below - cheaper car. The premium rates noted are for comparison purposes only and also are based upon typical minimal liability insurance coverage.

As you get older, those percents minimize by 68 percent for men and 64 percent for ladies by the age of 55. There are likewise various other elements that we uncovered either raising or lower your insurance expenses - car insurance. If you have youngsters, adding them to your protection once they enter teenage years will certainly elevate your premiums dramatically.

Discounts may additionally apply if your college-bound young person will just drive occasionally. New and young motorists New drivers not only pay more than various other chauffeurs for auto insurance coverage, but they pay a lot much more. According to the chart below, a 20-year-old man driver will certainly spend $1134 each year for standard minimum liability insurance coverage - affordable car insurance.

All About How To Save On Car Insurance For New Drivers (2022 Guide)

A new chauffeur, particularly a teen, might have to spend more than $1500. That might not appear reasonable, but data reveal that young chauffeurs have a considerably higher probability of being associated with a crash than knowledgeable vehicle drivers. cheap auto insurance. Youthful chauffeurs, for example, are a lot more most likely to be included in collisions.

They're 3 times more probable than 20-year-olds to be entailed in an accident. While kids are much less most likely to consume than adults, they are extra most likely to be entailed in a cars and truck crash when they do. Teenagers are less most likely to use seat belts as well as are extra most likely to speed up and tailgate.

They're likewise more likely to misjudge the severity of the scenario. Teen vehicle drivers pay much greater car insurance coverage costs than various other age as an outcome of these aspects. At the end of this message, we'll give some ideas for reducing those rates. Chauffeurs between the age range of 20 as well as 24 Around the age of 20, car insurance coverage rates start to wane.

You should anticipate to spend a lot more on car insurance policy if you're a brand-new vehicle driver aged 20 or older than somebody of the very same age that has actually been driving for a number of years. cheaper. Most vehicle rental businesses will certainly not employ an automobile for a vehicle driver under the age of 21. If you are in between 21 as well as 24, they will bill you a greater rental expense.

Between the ages of 25 as well as 30, there is a significant difference. Motorists between the age array of 25 and 65 This is the age when cars and truck insurance policy premiums start to end up being more economical. Using the very same instance of a 20-year-old man driver paying $1134 each year for common minimal liability insurance coverage, we can see that at the age of 30, the costs drops to $558.

cheapest car insurance cheaper auto insurance insured car insurance affordable

cheapest car insurance cheaper auto insurance insured car insurance affordable

London has to do with $1,400 every year. Mississauga mores than $2,000 each year. Hamilton is around $1,600 yearly. Some various other factors that influence prices for auto insurance coverage Numerous things have a direct influence on the cost of auto insurance policy. cheapest auto insurance. Some you have control over (what you drive, driving background) and also others you do not (insurance policy sector variables).

Some Known Details About 7 Factors That Raise And Lower Your Car Insurance Rates In Ontario

There are likewise individual considerations you can not regulate, such as your age as well as sex. Will the cost of insurance policy go down for chauffeurs? Even though the Ontario rural government has actually made promises to obtain insurance policy under control, the annual average prices are still on the surge. insurance.

Nevertheless, people are starting to get a break to some extent. You need to take essential actions to reduce repayments such as contrasting quotes yearly to obtain the least expensive car insurance as well as functioning with an insurance coverage professional. In regards to age, you can anticipate to start seeing lower costs as soon as you transform 25.

Conserving Cash on Teenager Vehicle Insurance Plan So you've obtained your new vehicle driver's license and also, as you're most likely conscious, it's unlawful to hit the streets without automobile insurance policy. You most likely likewise know that insurance rates are based on exactly how likely you are statistically to get involved in an accident. As a first-time vehicle driver, the numbers aren't on your side.

There are some things teenagers as well as parents can do to save money on insurance rates. Hop on your parents' plan (vehicle insurance). It's usually more affordable to add a teen to their parents' plan, instead than be insured individually. Many companies won't bill an extra costs until the teenager is an accredited chauffeur.

Intentional concealment could impact coverage. cars. Great qualities settle. The majority of insurers provide a discount rate, some as high as 25%, for trainees that keep a B average. Driver experience. Finished Chauffeur Licensing legislation requires teenagers to log 50 hours with a knowledgeable chauffeur, however taking a formal chauffeurs educating course will likely save money on insurance.

Penalties can land you back in the passenger seat. Death and also injury are the greatest cost vehicle drivers can spend for alcohol consumption and driving, yet also if you handle to endure, a D.U.I. ticket will certainly set you back teenagers huge time. auto. As a teen vehicle driver, you'll likely be terminated and also if you can obtain insurance coverage, anticipate to pay a much greater price for the next 3-5 years.

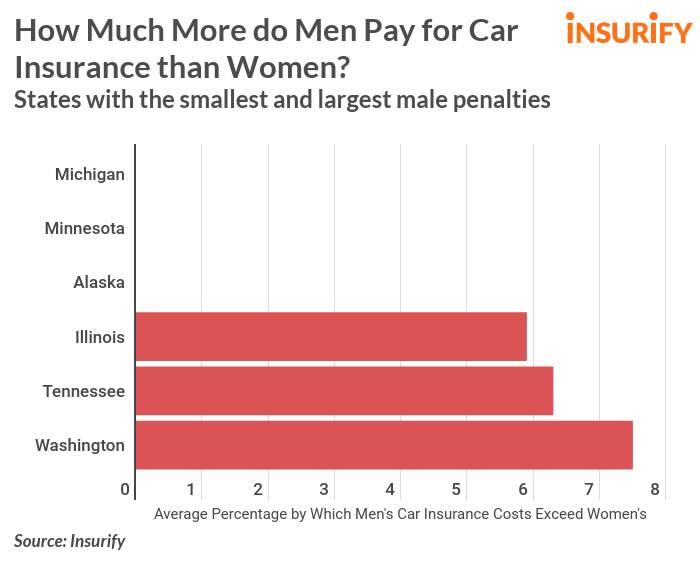

A Biased View of Do Men Really Pay More For Car Insurance? - Insurancequotes

London has to do with $1,400 every year. Mississauga is over $2,000 each year. Hamilton is around $1,600 every year. A few other variables that influence prices for vehicle insurance coverage Many points have a straight effect on the rate of car insurance policy. Some you have control over (what you drive, driving history) and others you do not (insurance sector factors).

There are additionally individual factors to consider you can not regulate, such as your age and sex. Will the cost of insurance coverage go down for chauffeurs? Also though the Ontario provincial government has made guarantees to obtain insurance policy under control, the annual standard prices are still on the rise.

Nevertheless, individuals are beginning to get a break to some degree. You require to take important steps to lower payments such as comparing quotes every year to obtain the least expensive automobile insurance and functioning with an insurance specialist. vans. In regards to age, you can anticipate to begin seeing reduced costs once you turn 25.

Saving Money on Teen Vehicle Insurance Plan So you have actually got your new chauffeur's certificate and, as you're possibly mindful, it's prohibited to hit the streets without auto insurance coverage. You most likely additionally recognize that insurance prices are based upon exactly how most likely you are statistically to enter a crash. As a new vehicle driver, the numbers aren't on your side.

However, there are some points teens and also moms and dads can do to save cash on insurance rates. Obtain on your parents' plan. It's typically less costly to add a young adult to their parents' policy, as opposed to be insured independently (cheapest auto insurance). Most business won't charge an added premium till the teen is a certified motorist.

Calculated concealment can impact coverage. Great grades pay off. The majority of insurance providers supply a discount, some as high as 25%, for pupils who maintain a B standard. Chauffeur experience. Finished Motorist Licensing regulation requires teenagers to log 50 hrs with a skilled vehicle driver, however taking an official vehicle drivers educating program will likely minimize insurance policy (perks).

The Ultimate Guide To What Age Does Insurance Go Down? Cheaper Car Insurance ...

insurance liability insurance insure

insurance liability insurance insure

Fines can land you back in the traveler seat. Fatality as well as injury are the highest price vehicle drivers can pay for drinking and driving, but even if you manage to make it through, a D.U.I (auto). ticket will certainly cost young adults big time. As a teen motorist, you'll likely be cancelled and also if you can obtain insurance coverage, expect to pay a much greater rate for the next 3-5 years.

Some various other variables that affect prices for automobile insurance Many points have a straight influence on the price of automobile insurance coverage. Some you have control over (what you drive, driving background) as well as others you do not (insurance coverage industry aspects).

Having an at-fault mishap on your document means higher insurance coverage. There are likewise private factors to consider you can not regulate, such as your age and also gender. For even more info please most likely to our web page and also see what aspects impact Ontario auto insurance coverage prices quote. Will the price of insurance policy drop for motorists? Even though the Ontario provincial federal government has made promises to obtain insurance coverage in control, the yearly standard prices are still growing - automobile.

Individuals are starting to obtain a break to some degree. In terms of age, you can expect to start seeing lower costs as soon as you turn 25.

Conserving Cash on Teen Car Insurance Coverage Plans So you've obtained your new chauffeur's certificate and, as you're possibly conscious, it's unlawful to hit the roads without car insurance policy. You most likely also recognize that insurance coverage rates are based on how likely you are statistically to get right into a collision. As a newbie motorist, the numbers aren't on your side.

vehicle cheaper cars automobile credit

vehicle cheaper cars automobile credit

Yet, there are some things teenagers and parents can do to save cash on insurance policy prices. Get on your moms and dads' plan. It's usually less expensive to include a young adult to their parents' plan, rather than be guaranteed independently. Many companies won't bill an extra costs up until the teen is a certified driver. insure.

The Single Strategy To Use For At What Age Do Car Insurance Rates Begin To Decrease?

credit insurance affordable insurance company cheapest car insurance

credit insurance affordable insurance company cheapest car insurance

car auto insurance vans auto

car auto insurance vans auto

Vehicle driver experience. Finished Vehicle driver Licensing law requires teenagers to log 50 hours with an experienced vehicle driver, yet taking an official vehicle drivers training course will likely save on insurance coverage.

https://www.youtube.com/embed/OchGbuyTajg

Charges can land you back in the guest seat. Death and injury are the highest possible price vehicle drivers can spend for alcohol consumption and driving, yet also if you manage to survive, a D.U.I. ticket will certainly cost teenagers large time. As a teen chauffeur, you'll likely be cancelled and if you can obtain insurance coverage, expect to pay a much higher price for the following 3-5 years.