Not known Facts About Revealed – Which States Have The Most Expensive And ...

A business's monetary strength is a sign of its ability to pay you after a covered loss (cheaper auto insurance). Trying to find insurance provider with great monetary strength rankings from AM Best, S&P, and Moody's might help you feel more positive in a company's capability to pay claims. Get a sense of what clients think about the company.

If you are currently dissatisfied with your vehicle insurance coverage rate, consider searching by comparing your price to quotes from other companies. insure. You can also contact your existing business to see if there are any other discounts you are qualified for however are not presently receiving on your insurance coverage.

These are sample rates and should just be used for relative purposes - insure. About the Authors, Jessie has actually been writing professionally for over a decade with experience in a variety of different subjects and industries. She currently lives in the stunning Outer Banks where she works as a freelance author and marketing expert full-time.

Our list of the best low-cost vehicle insurer integrates trusted protection, financial strength, and first-rate customer service at an inexpensive cost for your family. affordable. How to Compare Cost Effective Car Insurance Coverage Companies There are a number of aspects to consider when comparing economical cars and truck insurance coverage companies. Insurance provider can differ in the coverage they offer.

If you get in an accident, how simple is it to submit a claim? Can you send it online, or do you require to call? Some companies have much better online interfaces than others, or permit you to talk to a local representative to discuss your policy and claims. Some even have mobile apps. cheaper car insurance.

Power for client service, industry rankings can assist you determine what to get out of an insurance business. Picking a Cheap Vehicle Insurer Prior to you choose any cars and truck insurance coverage business, we strongly advise putting in the time to shop your options. Collect and compare automobile insurance coverage prices quote from numerous companies to discover the best coverage for your needs at the finest price.

Not known Factual Statements About Travelers Insurance: Business And Personal Insurance ...

Base your decisions on which protections and deductibles you choose on the age and value of your automobile. While things like GAP coverage and collision/comprehensive make sense for more recent vehicles, they don't constantly provide any real advantages to drivers with older, high-mileage automobiles. How We Selected the Finest Inexpensive Vehicle Insurer Our team assessed 25 insurance coverage business and gathered thousands of data points before selecting our leading choices.

The money we make helps us give you access to complimentary credit rating and reports and helps us develop our other excellent tools and instructional materials. Compensation might factor into how and where products appear on our platform (and in what order). Since we typically make cash when you find an offer you like and get, we attempt to show you offers we believe are a good match for you.

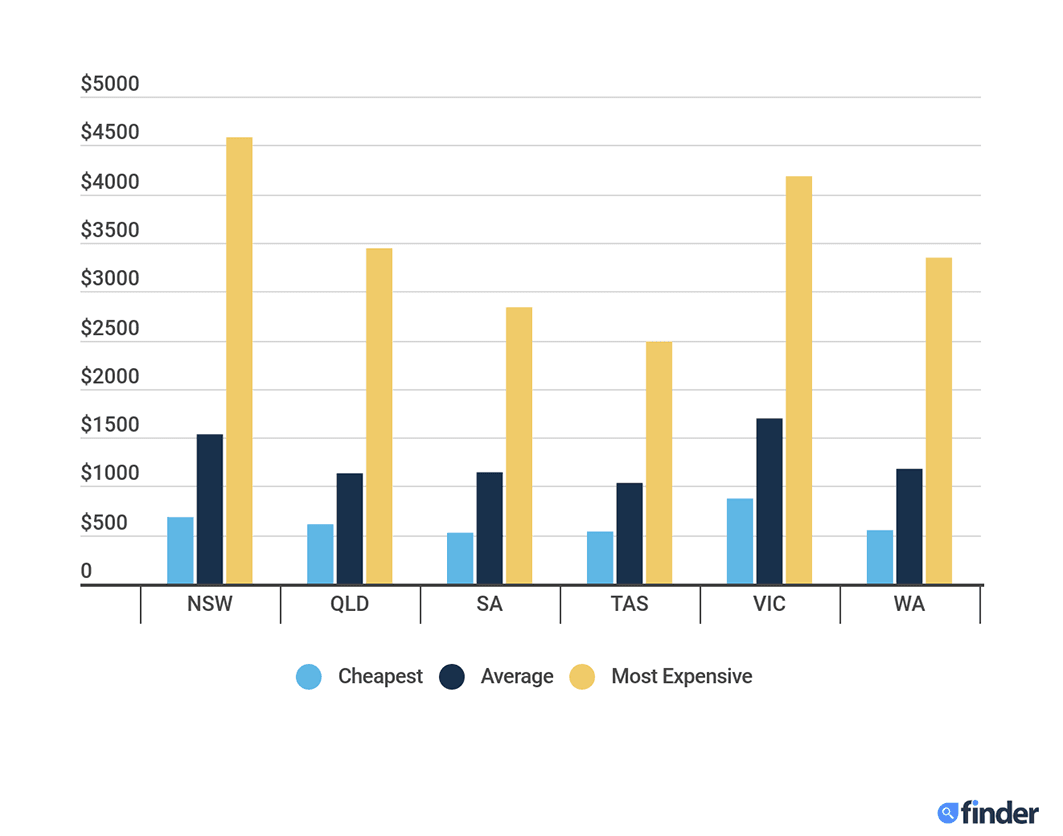

One of the easiest ways to shop around for insurance protection is to compare automobile insurance companies online. If you prefer to evaluate insurance options with someone, working with a cars and truck insurance agent is another method to go. It's not simply your driving record that identifies the insurance estimates you get.

They utilize claims information and personal information, amongst other aspects, to evaluate this danger. In some states, your credit can have some influence on your premium (though California, Massachusetts and Hawaii have all banned the practice of utilizing credit-based insurance coverage scores to assist identify rates).

a 2015 Customer Reports study shows that single participants with simply "excellent" credit paid as much as a massive $526 more a year (depending on their state) than similar chauffeurs with the very best credit report. In addition to credit, your insurance rates might likewise be affected by the list below aspects: Specific areas have higher-than-normal rates of mishaps and lorry theft.

The more pricey your cars and truck is, the higher your insurance coverage rates might be. Insurance companies can likewise look at whether chauffeurs with the same make and model tend to file more claims or remain in more accidents, along with safety test results, cost of repairs and theft rate. Putting less miles on your vehicle every month can affect the rates you get.

What Does The Cheapest Car Insurance In The Us For Young Drivers Do?

They could all be at danger if you cause an accident that results in medical or home damage expenses that exceed your coverage limitation (laws). You might want to select coverage limitations that, at minimum, show the worth of your combined possessions.

He delights in offering readers with details that can make their lives happier and more extensive (cheapest car insurance). Warren holds a Bac Learn more. Find out more.

Do not focus on premiums alone when searching for low-cost insurance, Drivers looking for inexpensive insurance coverage should not jeopardize defense for price. While it's an excellent idea to search to discover a budget friendly automobile insurance coverage carrier, drivers need to watch out for dropping optional protection or maintaining only minimum protection in order to conserve on premiums.

Motorists might want to consider acquiring: Crash insurance to pay for damages to their own lorry if they trigger a crash. Uninsured/underinsured motorist coverage, which is needed in some states and which pays for the insurance policy holder's damages triggered by a driver who does not have any or enough insurance coverage.

Purchasing minimum necessary protection is unquestionably cheaper. The national average premiums for liability-only protection can be found in at simply $764. Nevertheless, without optional security, drivers could be forced to pay to repair or change their vehicle out of pocket if something fails. Their insurance would only cover losses they trigger to others.

Insurance companies take credit scores into account when setting premiums. That's why motorists will need to search more thoroughly to find the most cost effective providers when their credit rating isn't as high as they 'd choose. Based upon an evaluation of insurance data from numerous states, the most economical insurance companies for bad credit include: Geico: Geico offers economical alternatives for chauffeurs with low credit.

Some Known Facts About Farmers Insurance: Insurance Quotes For Home, Auto, & Life.

State Farm: State Farm likewise consistently offers more economical premiums for low-credit chauffeurs than competitors do - cheap car., a motorist will be more expensive to insure due to the fact that insurance coverage business fear another accident is likely in the future, suggesting the insurer may have to pay out another claim. Some insurance companies do not penalize motorists as much as others do, so vehicle drivers with an accident on their record should shop around carefully for coverage.

Insurance coverage can be frustrating, and we do not desire you to feel that way. low-cost auto insurance. We're here to assist you as you make the decisions for your distinct way of life and financial resources.

Get a car insurance coverage quote from The General by submitting your ZIP Code and some other information about any insurance coverage exclusions, credit history, and liability. Insurance provider check your ZIP Code for the number of mishaps in the location. If you live in a place with a high accident rate, usually metropolitan areas, expect to pay more for automobile insurance than someone living in a light traffic region.

Constantly inform the reality about any traffic offenses you've gotten, since the insurance coverage company will discover out, and it will impact your premiums. Some insurance provider will decline you if you did not have at least 6 months of prior vehicle insurance protection, but that's not the case with The General (automobile).

The 10-Second Trick For The Cheapest Car Insurance In The Us For Young Drivers

Insurer supplement that info by gathering large quantities of data from customer claims. cheapest car. More secure vehicles are frequently less costly to guarantee, and insurers often offer discount rates to consumers driving much safer cars. On the other hand, some insurance providers increase premiums for cars and trucks that have bad security records and are more vulnerable to damage or resident injury.

The longer an insurance provider guarantees a type or design of vehicle, the more data it needs to figure out reasonable prices - insurers. If the vehicle has constructed a solid track record over several years, odds are it will insure at a reasonable rate, and remain steady gradually. Alternatively, cars with bad security history or those that are a favorite target for thieves will be more expensive to guarantee.

Insurance coverage business have actually found that previous efficiency typically does foretell future outcomes. If you've had speeding tickets or mishaps, or other infractions within the last couple of years, your auto insurance rate might be greater than if you have a spotless driving record.

It simply makes sense, the more time on the roadway increases the possibilities of being associated with a crash or sustaining damage to your automobile (cheapest car). Size matters, You may think smaller automobile, smaller sized insurance premium. Not so quickly. In an accident, larger vehicles tend to fare better and keep residents much safer than smaller automobiles.

Anti-theft devices, If your cars and truck has an alarm, a tracking device to help police recuperate it, or another theft deterrent, it's less appealing to burglars, and less costly to guarantee, too. Your credit report, Research study has actually shown that excellent credit is connected to great driving and vice versa (insurance). Particular credit info can be predictive of future insurance claims.

The bottom line: Great credit can have a favorable impact on the expense of your cars and truck insurance coverage. Your age, sex, gender and marital status, Crash rates are higher for all motorists under age 25, specifically single males. Insurance costs in many states reflect these differences. If you're a trainee, you might likewise be in line for a discount.

The Greatest Guide To Top 11 What Is The Cheapest Insurance For Young Drivers ...

Where you live, Normally, due to greater rates of vandalism, theft, and crashes, city drivers pay more for automobile insurance than do those in towns or backwoods. You likely can't quickly alter where you live, but if you do reside in a high insurance location make sure to pay attention to the other elements that you can manage (cheap car insurance).

By doing some homework in advance about potential auto insurance rates, you can make a notified decision to ensure you have the right car at the best rate of owning it. See if ERIE can Deal a Cheaper Vehicle Insurance Rate, Ready to find out more about budget friendly vehicle insurance coverage from ERIE? Check out about our and begin an automobile insurance coverage quote today.

Great student discount rate Cheap vehicle insurance coverage for trainees is possible with Nationwide. Smart, Trip discount Smart, Ride is a tracking tool we use to reward safe driving. Here's where rubber genuinely satisfies the road plug the device into your automobile and it will track your driving practices, such as tough braking, speed and so forth.

https://www.youtube.com/embed/nRsmk-cFrb0

Where you keep your vehicle - Rates are identified to some degree by the area in which you live and park your cars and truck. The variety of chauffeurs on your policy If you include someone to your policy, your rate will increase, especially if that "somebody" is a new teenager driver.