The Of States That Don T Require Car Insurance - Visit Wexford

You can not legitimately drive in any state without demonstrating financial responsibility for problems or responsibility in the event of a mishap. In the majority of states automobile insurance coverage is compulsory as evidence of this responsibility. All states have financial obligation laws so, in states where there is no responsibility insurance demand, you require to have evidence of sufficient properties to make restitution, clinical bills as well as more if you trigger a mishap (cheapest car).

Understand what is covered by a standard automobile insurance policy.. insurance.

Review of lorry insurance policy in the United States of America Automobile insurance coverage, car insurance policy, or vehicle insurance in the USA as well as in other places, is developed to cover the danger of monetary responsibility or the loss of a motor car that the owner may encounter if their automobile is entailed in an accident that causes property or physical damages - cheaper cars.

, which uses vehicle proprietors the option to upload money bonds (see below). The insurance premium an electric motor automobile proprietor pays is normally identified by a selection of elements including the type of click here covered lorry, marriage status, credit rating, whether the motorist rents or possesses a residence, the age and also sex of any type of protected drivers, their motoring background, and also the area where the vehicle is primarily driven and kept.

Insurer supply a motor car proprietor with an insurance card for the certain protection term, which is to be maintained in the car in the event of a traffic accident as evidence of insurance coverage. Just recently, states have started passing laws that permit digital variations of evidence of insurance to be approved by the authorities.

Is It Illegal To Not Have Car Insurance? Can Be Fun For Anyone

Insurance coverage is sometimes seen as 20/40/15 or 100/300/100. The very first 2 numbers seen are for medical coverage (cheaper car).

You can likewise purchase insurance if the various other chauffeur does not have insurance coverage or is under guaranteed.

Commercial insurance coverage for automobiles possessed or run by organizations functions rather comparable to personal car insurance policy, with the exception that individual use of the lorry is not covered. Industrial insurance pricing is also usually more than exclusive insurance policy, because of the expanded types of coverage supplied for business users. Insurance policy carriers [modify] In the USA in 2017, the largest private traveler automobile insurance policy carriers in regards to market share were State Ranch (18.

The amount of protection supplied (a repaired buck amount) will certainly vary from territory to territory - cheapest car. Whatever the minimum, the insured can normally increase the protection (before a loss) for a service charge. An instance of residential or commercial property damages is where an insured driver (or first celebration) drives into a telephone post and also harms the post; responsibility coverage pays for the damages to the post. cheap.

car car insurance cheaper cars car insurance

car car insurance cheaper cars car insurance

An instance of bodily injury is where an insured vehicle driver creates physical injury to a 3rd party and the insured driver is considered in charge of the injuries - insurance. Nevertheless, in some jurisdictions, the 3rd party would initially wear down insurance coverage for accident benefits via their very own insurance company (thinking they have one) and/or would need to meet a lawful meaning of extreme impairment to can claim (or sue) under the insured chauffeur's (or initial event's) policy.

In some states, such as New Jersey, it is unlawful to run (or intentionally allow another to operate) an electric motor automobile that does not have obligation insurance policy protection. low cost auto. If a crash occurs in a state that calls for obligation coverage, both events are normally called for to bring and/or send copies of insurance cards to court as proof of obligation insurance coverage - cheap car.

The smart Trick of Is It Illegal To Not Have Car Insurance? That Nobody is Talking About

An insured motorist with a consolidated solitary obligation limit strikes one more car as well as hurts the driver and also the guest. Repayments for the damages to the other driver's vehicle, in addition to payments for injury insurance claims for the motorist and guest, would certainly be paid under this exact same protection.

One of the extra interesting ones, nevertheless, is that the bond applies to you as well as not your car. This suggests you can drive any type of car you want with a bond and also not fret regarding whether or not you are covered.

laws auto insurance trucks suvs

laws auto insurance trucks suvs

perks cheapest insurers vehicle insurance

perks cheapest insurers vehicle insurance

Though you might have a large checking account, you can really easily shed everything after a single crash. If we do not also consider the costs for clinical treatment, think about a new automobile's expense - car insured. Nowadays, lots of brand-new vehicles price between $30-$50k, which is likely more than sufficient to erase any kind of bond or money deposit with your state (if not your whole financial savings account).

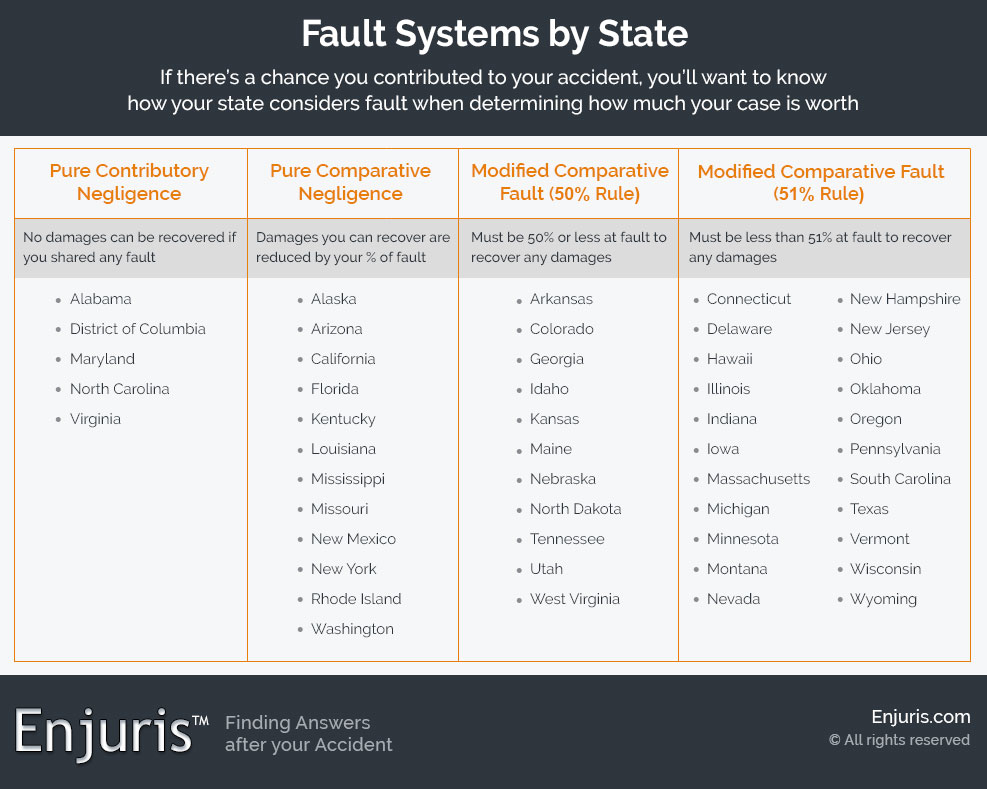

New Hampshire and Virginia are the only 2 states that don't require cars and truck insurance policy. That claimed, there is no one country-wide regulation when it pertains to how much auto insurance coverage you have to have. Each state has a different minimum quantity of automobile insurance that motorists should get in order to legitimately drive on public roadways.

Some states only need liability insurance coverage, which covers physical injury (BI) as well as residential property damage (PD) you do to somebody else. vehicle. Other states could call for added clinical coverage or what's commonly referred to as individual injury security (PIP), which covers wellness treatment expenses you or your travelers sustain. As well as some states may need without insurance and/or underinsured motorist insurance policy, but after that in other states this kind of insurance coverage can be optional.

If you're puzzled, there's good news: You actually just need to stress over the needs where you live, so you can leap to your residence state as well as see to it your protection fits the obligatory minimums. cheap insurance. Trick Takeaways You need to meet the minimum quantity of auto insurance coverage called for in your state, Obligation coverage, the backbone of every vehicle insurance plan, is required in practically every state, Comprehensive and crash protection are not mandated in any type of state, but given that they pay to repair damage to your vehicle, we highly suggest adding them to your plan, Some states require injury protection (PIP) which covers prices you or your passengers incur if you're injured in a crash What sorts of auto insurance protection are called for? Cars and truck insurance policy needs differ, yet almost all states call for drivers to have some quantity of responsibility coverage (cheaper car).

The Ultimate Guide To Esurance Car Insurance Quotes & More

Listed below we damaged down the basic elements of what's generally referred to as a "complete coverage" automobile insurance coverage plan: Bodily injury responsibility, The part of your responsibility insurance coverage that spends for medical costs if you've injured somebody in a crash, Residential property damage liability, The other component of responsibility coverage, covers the price of building damages you've triggered in a crash, Personal injury security, Covers clinical expenditures for you or your guests after a crash, Uninsured/underinsured motorist, Covers the expenses if you remain in an accident triggered by a chauffeur with little or no cars and truck insurance coverage, Comprehensive, Covers damage to your car that takes place when you're not driving, Crash, Covers damage to your auto after an automobile mishap, despite that was at fault, Like we discussed above, thorough and accident coverage are optional in every state, yet this kind of protection provides beneficial defense for your car, which isn't covered by your obligation protection.

And crash insurance coverage covers damage from crashes no matter that was at mistake. Find out more about thorough and also crash protectionAuto insurance policy demands for all 50 states, You require to fulfill the minimum quantity of auto insurance policy need based on the state you live in, suggesting your long-term address. auto. If you relocate out of state, you might require to include extra cars and truck insurance coverage to your plan based upon your new state's requirements (insurance companies).

While vehicle insurance is not necessary in either state, citizens are still accountable for bodily injury or home damage they trigger. Should I obtain minimum-coverage or full-coverage auto insurance policy? Vehicle insurance policy minimums are indicated to be a starting point for coverage, but they may not cover the full cost of a mishap, as well as the minimums alone may not pay for damage to your lorry (insure).

An important detail to keep in mind if you funded or lease your car, your lienholder or lessor likely needs you to have comp and also accident on your vehicle insurance plan. There are some motorists for whom it makes feeling to drop compensation and crash insurance coverage, like if your cars and truck is currently worth so little that if it were damaged in a crash it would not deserve paying to fix it (cheap car).

What occurs if you obtain caught driving without your state's required amount of insurance coverage? The effects of driving under guaranteed or driving uninsured vary from one state to another. If you obtain pulled over, or get involved in an auto mishap, as well as you do not have your state's required amount of car insurance policy, there are a couple of points that can take place. prices.

It covers any type of damage or injury to other chauffeurs and also their vehicles that you create in a crash. Some states, called "no fault states" need drivers to utilize their own insurance to cover any injuries after a mishap in these states, vehicle drivers are needed to have injury protection. Do you have to have automobile insurance in the state you live in? Your car should be signed up in the state where you live and guaranteed approximately (as well as beyond) the minimal cars and truck insurance demands because state.

Excitement About Is Car Insurance Mandatory? Carchex Answers

https://www.youtube.com/embed/lRtHa4rosUkIn New Hampshire, locals are likewise still required to pay for any type of bodily injury or property damages they cause if they don't have auto insurance coverage, and also the very best way to cover those costs is to have car insurance coverage. vehicle.