The 9-Second Trick For Florida Full Coverage Auto Insurance

The average yearly cost of vehicle insurance coverage in Florida for a 40-year-old motorist with a tidy driving document purchasing a full insurance coverage plan is $2,208. insurance. The state minimal car insurance coverage for the same 40-year-old driver would just set you back approximately $1,123 per year. Prices varies dramatically with your driving account (perks).

Money, Geek looked into typical insurance policy prices in Florida based upon numerous elements to aid you recognize how these variables influence the prices. Ordinary Price of Cars And Truck Insurance Coverage in Florida: Summary, Cash, Nerd examined exactly how insurance rates in Florida adjustment with certain elements. The vehicle driver's age and credit report score most dramatically influence ordinary automobile insurance coverage rates in the state.Multiple aspects affect auto insurance policy costs. Florida is also understood for its vulnerability to all-natural catastrophes, which usually cause higher costs. Furthermore, Florida is a no-fault state. Insurance providers need to cover the insured despite that is at fault, causing high insurance coverage prices in the state. Average Price of Cars And Truck Insurance in Florida: Full Coverage vs. The typical cost of complete protection automobile insurance in Florida is $2,208 per year a substantial difference of $1,085. The quantity of protection you pick also influences the average expense of lorry insurance policy in Florida. Insurance companies offer several coverage options. Obligation protection is commonly the state minimum, with or without add-on coverages. The state rates 6th for its number of without insurance motorists, is vulnerable to natural catastrophes and also has a considerable price of lorry thefts. Its status as a no-fault state additionally adds to the state's costly automobile insurance coverage prices (trucks). Just how much should you spend for auto insurance policy in Florida? Estimate your standard insurance coverage premium in Florida by contrasting prices for chauffeurs who share your account and also attributes. Information on without insurance drivers was drawn from 2019 information from the Insurance Study Council. Urban share of populace was calculated utilizing the latest data from the united state Census Bureau. Information on automobile burglary rate was attracted from the FBI Criminal Offense in the United States Record for 2019 (cheap). Concerning the Author. When it concerns vehicle insurance coverage, Florida is one of the most pricey states in the country. Vehicle drivers in the Sunshine State pay approximately

$2,364 every year for full insurance coverage, according to Bankrate's 2021 research of typical yearly complete coverage vehicle insurance policy rates from Quadrant Information Solutions - cheap auto insurance. Just how much is car insurance in Florida per month? For full protection, chauffeurs pay concerning$197 each month, generally. The nationwide ordinary premium is $1,674 annually for full protection, which indicates that Florida vehicle drivers pay virtually$700 even more every year, on standard, than chauffeurs across the country.

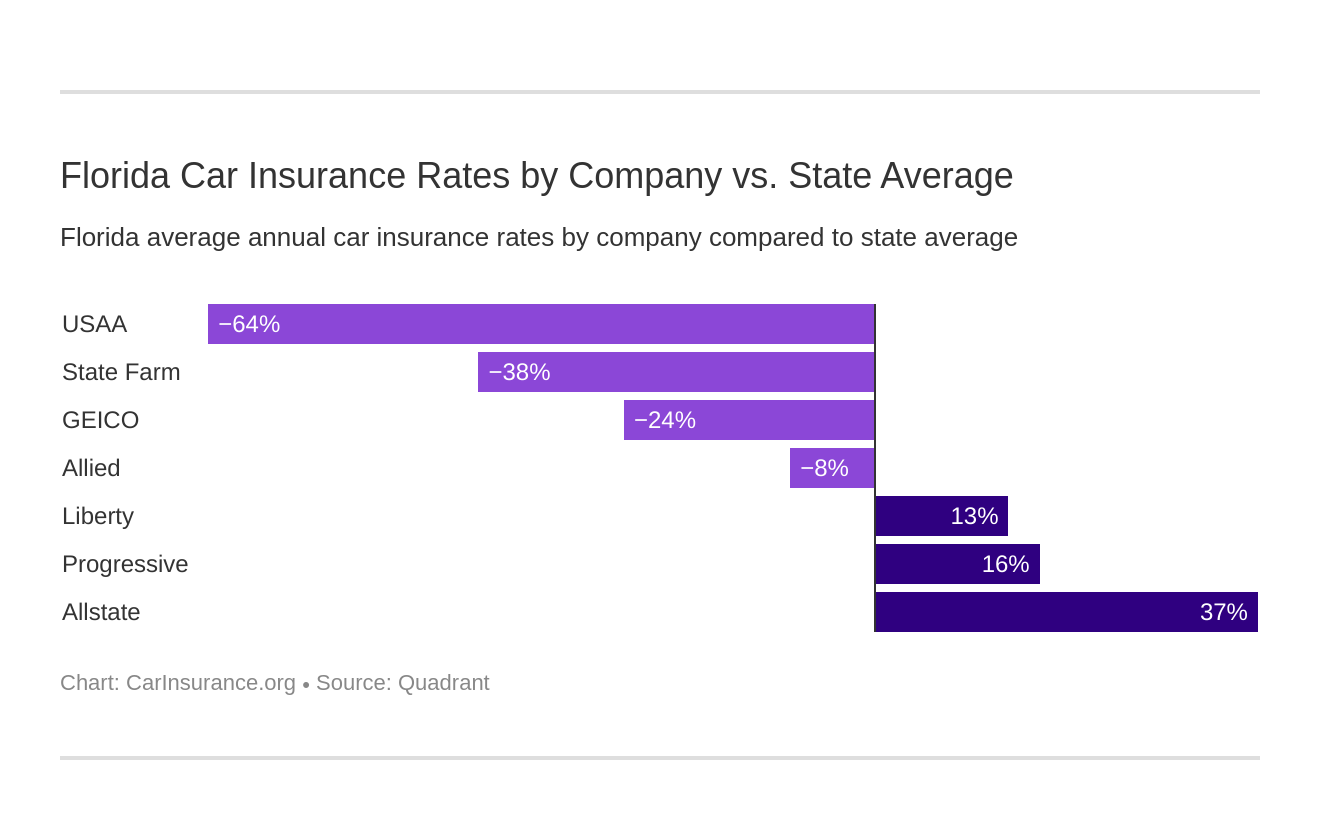

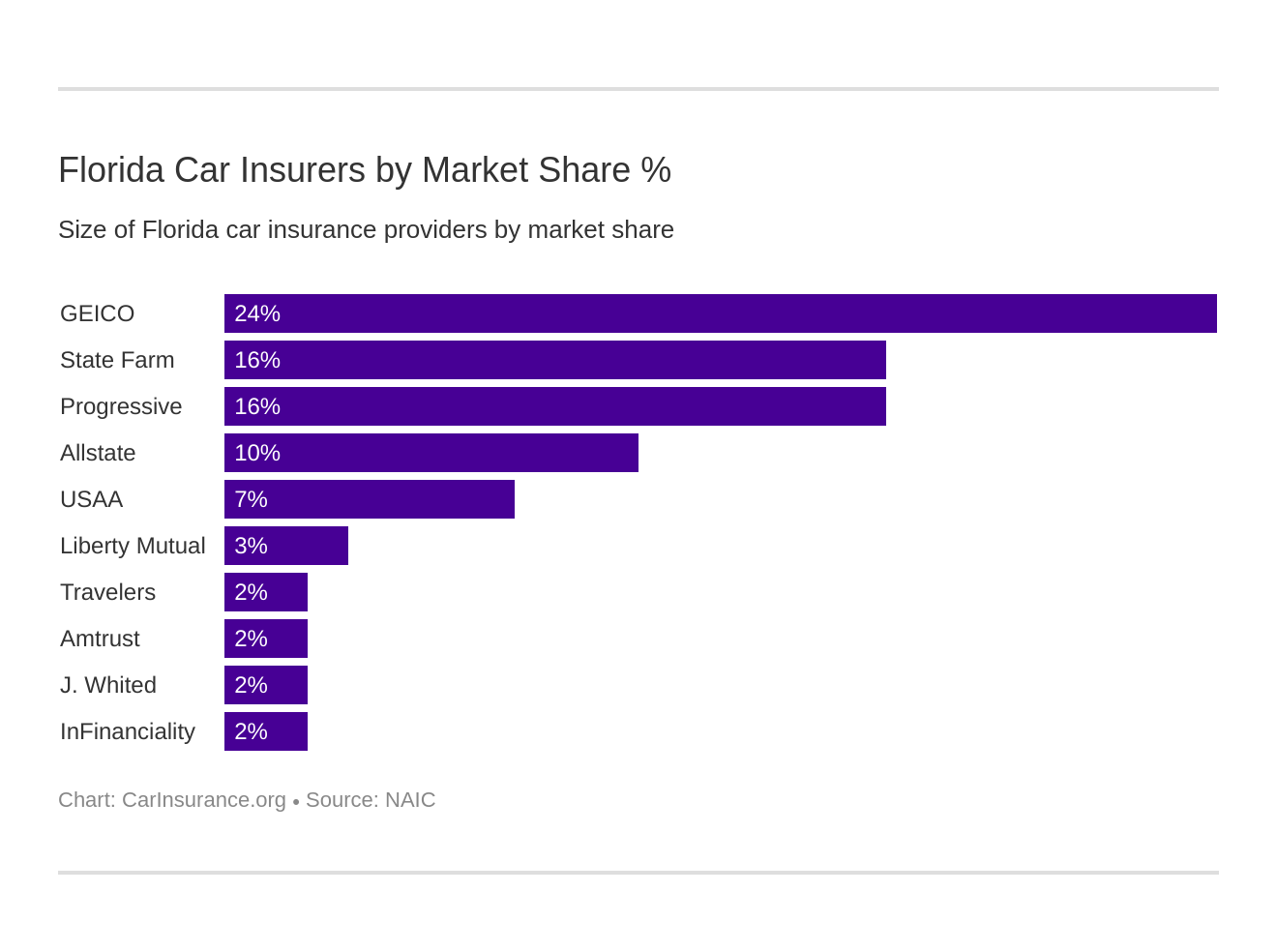

Bankrate's research study can assist you comprehend the typical cars and truck insurance coverage prices in Florida as well as the variables that affect your cars and truck insurance policy costs. Just how much is auto insurance in Florida? Florida drivers pay an average of$2,364 per year for full insurance coverage, which is 41 %greater than the nationwide yearly standard of$1,674. Nevertheless, your expense will depend upon a number of score elements, consisting of where you live within the state and also what insurance coverage kinds and also degrees you select. vehicle insurance. Florida car insurance coverage prices by company The most effective automobile insurance provider in Florida each have their own unique underwriting requirements, coverage offerings, discount rates and also policy functions. To provide you a concept of what you could anticipate to spend for vehicle insurance coverage in Florida, below are the average annual costs for complete protection for some of the biggest insurance provider by market share in the state. You might also desire to contrast coverage offerings, discounts, client solution scores and financial stamina ratings when picking an insurance provider. Price of living in Florida and cars and truck insurance coverage, When looking for the most effective cars and truck insurance coverage rates in Florida, it is essential to consider

your various other expenditures to ensure that you're looking at your overall living costs. If you are not sure how much time a surcharge might stay on your policy, you can call your insurance coverage representative or carrier to figure out. Florida vehicle insurance rates by car kind, Among the most significant elements in determining your automobile insurance coverage prices is the make and also design of automobile that you drive. The kind of lorry you drive can likewise affect just how much insurance coverage and what types of coverage you select. Frequently asked concerns, What is the most effective automobile insurer in Florida? Every driver brings a special collection of situations to their vehicle insurance coverage search, so the very best automobile insurance coverage business will certainly be various for everyone (business insurance).

When you understand what you desire from an insurer, you can acquire several quotes to assist you locate the insurance coverage you need at a competitive price. What is the typical cost of minimum insurance coverage in Florida? Having a vehicle policy with the state-required minimum coverage limitations in Florida sets you back a standard of$1,101 annually, virtually double the nationwide average of$565 annually. 4% uninsured vehicle driver price, one of the greatest in the U.S. according to the Triple-I, you may intend to consider including this insurance coverage on your plan. You might intend to think about higher responsibility restrictions or full coverage to better safeguard on your own in the event of a crash. Full insurance coverage, which includes crash coverage and detailed insurance coverage, is not called for by law yet will likely be needed if you have a funding or lease. These are sample rates and also need to just be utilized for relative purposes.: Prices were computed by examining our base profile with the ages 18-60 (base: 40 years)used. Depending upon age, chauffeurs might be a tenant or house owner. For teens, rates were identified by adding a 16 -or 17-year-old teen to a 40-year-old couple's policy. Prices were determined by evaluating our base account with the adhering to incidents applied: clean document( base ), at-fault accident, solitary speeding ticket, single DUI conviction and lapse in coverage. or Canada, PIP covers you as well as loved ones that stay in your house. In this instance, you should be driving your own vehicle. Individuals besides you or your relatives are not covered.(back to cover)Residential property damages obligation insurance policy pays for damages that you, or members of your family members, create to one more individual's residential property while driving. 1, 2007, you need to have$ 100,000 worth of protection each as well as$300,000 well worth of insurance coverage per accident. You also must have a minimum of $50,000 in residential property damage protection - automobile. BIL pays for severe as well as long-term injury or death to others when your automobile is associated with an accident and the motorist of your car is located to be to blame to some extent. It additionally covers individuals who drive your car with your authorization. With this kind of plan, the insurance provider likewise will certainly spend for your.

legal defense if you are sued.(back to cover )Although it is not required by legislation, several vehicle drivers buy other types of insurance policy coverage in addition to the required PIP as well as property damages responsibility insurance coverage. Accident insurance coverage spends for fixings to your auto if it hits another car, crashes right into an item or hands over. It pays no matter that creates the mishap. Crash insurance coverage does not cover injuries to people or damage to the home of others. Thorough insurance pays for losses from occurrences apart from a crash. Uninsured driver ( )insurance coverage pays if you, your passengers or relative are struck by someone that is "to blame"and also does not have insurance coverage, or has not enough responsibility insurance coverage to cover the overall damages endured by you. This applies whether you are riding in your automobile, riding in someone else's vehicle or are struck by a vehicle as a pedestrian. If you have crash protection or building damages responsibility, you might be covered for damages to rental vehicles driven by you, depending on the terms and problems of your plan. You also may be instantly covered by your charge card firm if you utilized the card to rent out the car.(back to top )Auto service warranties are great just for a specified length of time and also ensure just the fixing or substitute of items specified in the contract. Solution service warranties are agreements that are regulated by the Division of Financial Solutions. laws. Whether a service guarantee

is worth the money will certainly depend upon how the service warranty fits your requirements. Make certain to request the exact same insurance coverage from each so your contrasts will be exact. A quote is a quote of your costs it is not a firm rate or a contract. It is versus the legislation for a representative to deliberately quote you a low reduced costs to get your business - laws. False or inaccurate information could trigger the company to cancel your policy or refuse to pay a case. Constantly get a copy of the signed application kind. Make certain to obtain a binder from the agent when you authorize the application. A binder is your short-lived proof of insurance up until an official policy is released.

Make checks or money orders payable to the insurance provider never ever to the agent or the agency. You should get your plan no behind 60 days after the effective date. If you do not get your plan, contact your representative. Right away report any kind of changes impacting your plan to your representative. This needed coverage will not cover you if you are hurt in a motorcycle accident. Nonetheless, some insurance firms may supply PIP and clinical payment insurance for motorbikes as additional coverage that can be bought. In order to run or ride on a bike without headwear, you have to more than 21 years of age

All About Florida Car Insurance Guide (2021) - Carinsurance.org

and also have an insurance coverage providing at the very least$ 10,000 in clinical benefits for injuries suffered as an outcome of a crash. Finally, bear in mind these tips: Review your policy. cheaper auto insurance. Be certain you comprehend your plan. If you have any kind of concerns, call your representative or the Department of Financial Services toll-free at 800-342-2762. The selection of insurer and also agent is yours. You do not need to purchase auto insurance coverage from the dealer who sold you the cars and truck or the lending institution funding your vehicle. Insurance by State Florida Cars And Truck Insurance Coverage Florida is a no-fault state, suggesting that crash victims should look for recuperation for damages from their insurance providers, also if the various other motorist was accountable for the mishap. Bringing a lawsuit versus the at-fault vehicle driver is difficult, otherwise impossible under many circumstances - auto. Florida, like other no-fault states, has higher insurance policy costs than states without no-fault insurance coverage and is among the more pricey states in the country when it concerns vehicle insurance costs - cars. Florida Automobile Insurance policy Information No-fault insurance policy suggests all chauffeurs have to acquire minimum Personal Injury Defense(PIP)insurance policy and Home Damage Liability(PDL)insurance policy.

Icon-auto with a shield and also check mark- Accident Security insurance policy in Florida. The General Insurance automobile guard icon-Rapid, totally free quotes for fast protection Individual Injury Defense(PIP)Injury Protection Insurance policy covers the chauffeur as well as member of the family, in addition to anyone in the vehicle at the time of the mishap who does not have actually a signed up automobile and also PIP coverage. That exact same percentage likewise comprises the variety of foreign residents, among the largest in the country. Virtually 30 percent of youngsters talk a language aside from English in the residence. Florida Auto Insurance Policy & Accident Details Florida has the suspicious difference of the state with the largest variety of uninsured vehicle drivers. Area It prevails to pay more for business vehicle coverage in a larger city like Miami than a smaller city like Fort Meyers. Keep in mind, locations that experience even more claims are typically valued higher than various other locations. Locations at risk to weather-related occasions such as cyclones and also floodings are additionally variables. Understanding why the rates are so high in the initial place can help you lower your insurance coverage costs so you can delight in living in such an amazing state (credit). Why is Florida Vehicle Insurance Coverage

So Expensive? Due to the fact that Florida requires reasonably comprehensive cars and truck insurance, lots of people wonder concerning the cost of that kind of protection. Recognizing what these factors are can help you understand why insurance coverage is so costly there. Population, Florida has an unbelievably high population for its dimension, which makes it a really thick state.

https://www.youtube.com/embed/cC93FZEXYyc

Individual Injury Security Requirement, In the state of Florida, all chauffeurs are called for to have Individual Injury Protection insurance coverage. In Florida, there are a number of demographics that automobile insurance policy companies think about to be high risk. It needs to be kept in mind that demographics like this are starting to end up being less of a variable in automobile insurance policy costs as time goes on.