Getting My Why Is My Car Insurance So High? - J.d. Power To Work

This means that also if your cars and truck worth has actually decreased, the insurance provider assures to cover the complete worth of the vehicle at the time of purchase. This is supremely valuable when you undertake component adjustments due to harm a number of months or years after purchase. Such insurance coverage strategies additionally become complicated as your vehicle gets older. As the diminished worth of your auto increase, the margin for the insurance firm covering the non-depreciated worth of your auto increases as well as in order to guard versus threat, they are likely to enhance the premium quantity on your insurance coverage plan upon renewal. In such cases, the insurance provider is considered a different method of calculations as well as upon completion of your lock-in tenure would re-adjust their computation metrics which would certainly cause a higher insurance policy costs - money. This might be unexpected to you upon revival however if you think about reviewing the terms carefully, you'll locate that the insurance provider gives information of their estimation metrics for the specified period as well as what would certainly alter upload the tenure. cars. Sometimes, despite

an inadequate credit history, insurance business are mandated to give you with a favored costs amount although this might not use in all cases. When looking for a brand-new insurance plan or restoring an old one, you have to contact the insurance representative if the company is factoring in your credit report rating when determining your auto insurance premium.

There are a number of factors why the cost of your Cars and truck Insurance policy may go up when it comes to revival time. Does my Car Insurance coverage rise at every renewal? At Swinton, your revival price is based on the cover level you had the previous year, so keep in mind to tell us if there have actually been any changes to your circumstances any kind of distinctions might indicate there's a modification to the.

cost of price Car Insurance cars and truck (credit).

The Best Guide To How Auto Insurance Rates Have Changed Over The Past Decades

The company's report notes that prices have actually ballooned 28% over the past 10 years throughout the country. In the past year alone, The Zebra located that Louisiana ranked greatest when it comes to yearly price ($ 3,265), and New Hampshire was the most affordable ($ 999)." In 2021, vehicle drivers started taking their automobiles out of 'park' and went back to the roads," Nicole Beck, The Zebra's head of interactions, claimed.

The increasing ordinary price of vehicle insurance varies by state across the U - accident.S - insurers., as well as actually, the Dallas Early morning News reported that notifications filed with the state's Department of Insurance coverage showed that some insurance provider are planning price walkings of greater than 20% on standard. In Arizona, drivers are seeing similar patterns.

Geico, the report states, executed an 8% boost in November 2021, while Allstate filed a 7% increase in March of this year - insurance company. Insurance coverage expenses are predicted to most likely keep going up over the training course of the year. According to a report from Insurify, rates are predicted to expand an additional 5% in 2022, driven by rising rising cost of living.

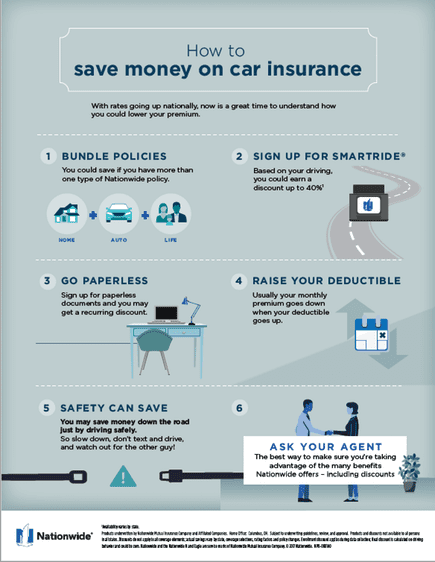

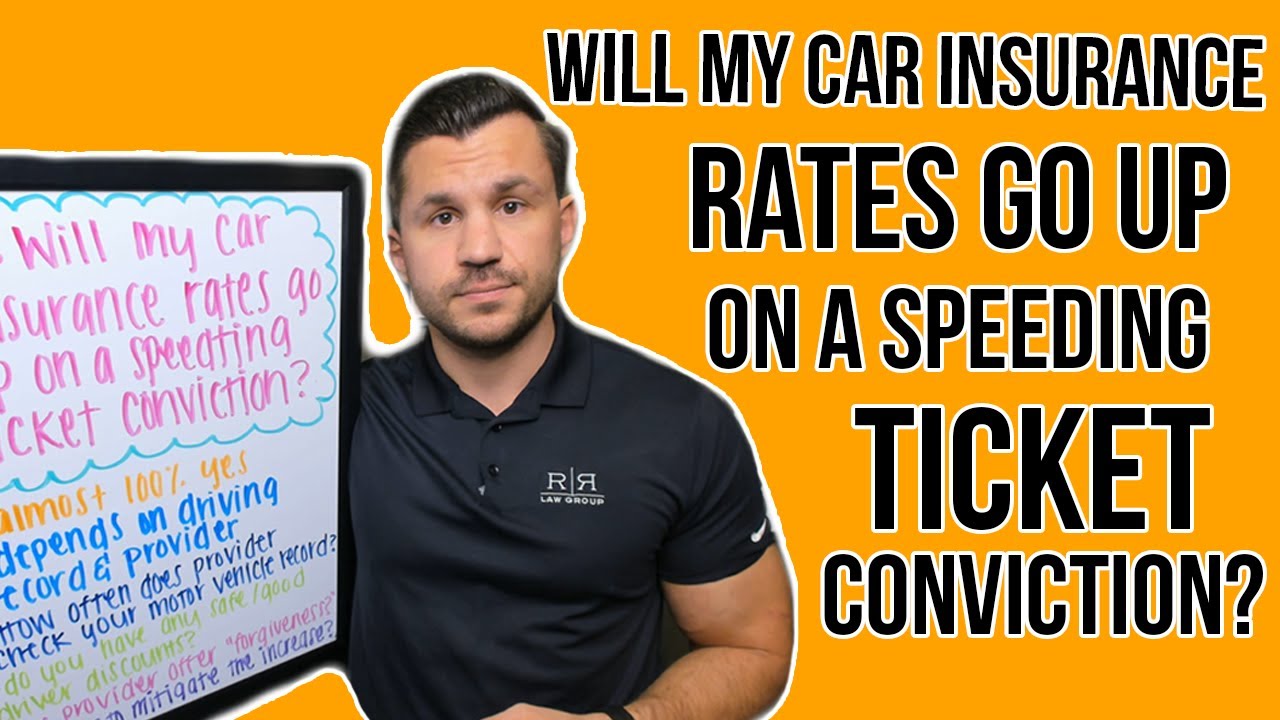

Visit Trustworthy to compare quotes from multiple automobile insurance suppliers simultaneously and select the one with the most effective price for you. Drivers can take several steps when it pertains to reducing the expense of their car insurance policy. In addition to preventing infractions like speeding tickets or at-fault mishaps that call for insurance claims, right here are some means that chauffeurs can save: Having a much better credit history can aid you secure a far better rate on your vehicle insurance coverage (car insured).

Visit Reliable to talk to an auto insurance coverage expert as well as get all of your inquiries addressed. Email The Qualified Cash Specialist at.

Your automobile insurance policy prices are in some methods a reflection of you, with the prices you pay based on factors such as your driving document and also where you live. auto insurance. If your premiums seem too expensive or have actually soared in current months, there are a range of feasible factors for it.

More About Why Is My Car Insurance So High? - Ramseysolutions.com

car cheapest perks auto

car cheapest perks auto

vehicle insurance business insurance auto insurance auto insurance

vehicle insurance business insurance auto insurance auto insurance

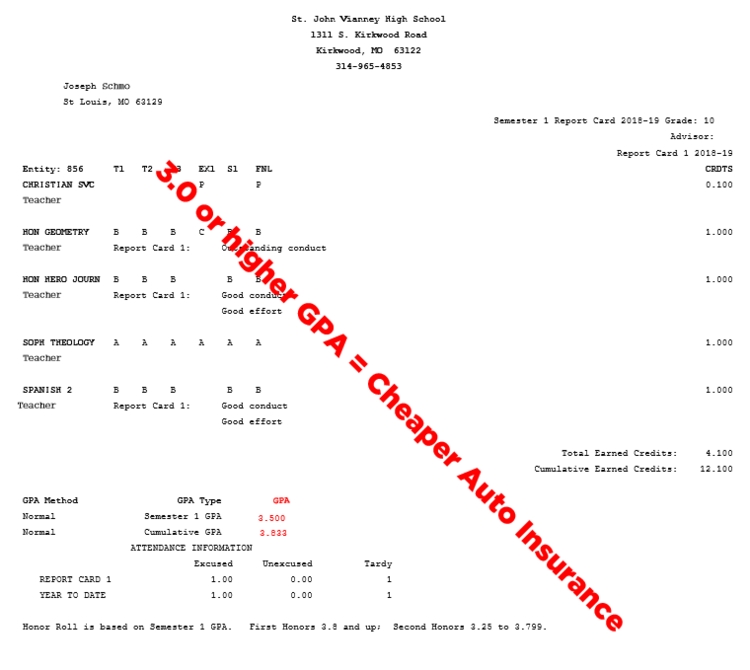

Americans paid a standard of $1,633 in 2021, with projections for 2022 approximated at $1,706. The ordinary American pays approximately $136 each month for vehicle insurance, according to Insurify, the insurance coverage comparison expense website. That's just a standard, of training course, and also the price you pay can be higher or lower, depending on many various aspects, such as: When you request a quote from an automobile insurance coverage company, one of the points they look at is your driving record, which can include any type of web traffic tickets you've received or mishaps you have actually experienced.

Insurance policy premiums can vary extensively from state to state and even from area Browse this site to area within the exact same state. If you live in a location with a high crime rate, your insurance provider might charge a greater price since it believes you're a lot more most likely to submit a case for theft or criminal damage.

Younger, much less knowledgeable motorists often tend to pay higher car insurance coverage prices since they're thought about most likely to have a crash than older motorists are. If a young chauffeur gets on a parent's automobile policy, that can also impact what the parent pays. Women often tend to have less and less significant vehicle accidents than their male equivalents, so they generally pay much less for insurance (car insurance).

That's because many vehicle insurance provider utilize your credit rating as a proxy for just how liable a person you are. If you're driving a super-expensive sports vehicle, your insurance policy prices will certainly be considerably more than if you were wallowing a practical sedan. That's since it will certainly cost more to fix or change the previous than it would certainly the latter after an accident. cars.

cheap cheaper automobile insurance

cheap cheaper automobile insurance

cars cars insurance perks

cars cars insurance perks

And according to the Insurance Information Institute, "Insurers not only consider just how safe a particular lorry is to drive and just how well it safeguards residents but additionally how much possible damage it can bring upon on another automobile. If a details car design has a higher chance of inflicting damages when in a crash, an insurance company might charge more for responsibility insurance policy." Suggestion Even if you do not assume your automobile insurance policy premiums are insanely high, it can be worth looking around each year or more to see if another insurance firm would bill you much less for the very same protection. vehicle.

auto insurance cheaper car insurance affordable car insurance affordable

auto insurance cheaper car insurance affordable car insurance affordable

If you're comfortable with that, it might be worth inspecting out. Because your credit history rating is frequently an important factor in setting your insurance policy rates, anything you can do to enhance it might pay dividends.

Rumored Buzz on Auto Insurance Rates Rise, But Insurers Brace For Higher Costs ...

https://www.youtube.com/embed/JWWBOyTgfusMany automobile insurers supply lower prices if you participate in an accepted protective driving course. You may likewise be needed to take a course if you're associated with a DUI or other crime. You may be eligible for a discount if you purchase your automobile, property owners, or various other plans from the exact same company. affordable.